New Feature: Bonus Eligibility Tracker

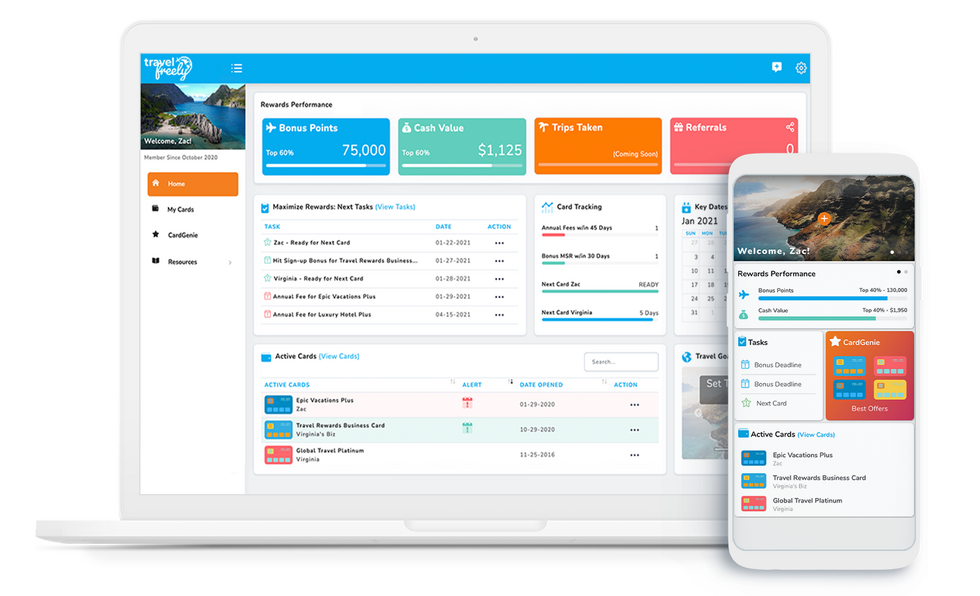

The CardGenie is one of the most helpful features of Travel Freely. It makes sure that you know the best available credit card offers while also making sure you’re eligible for the card. There are so many rules related to approval eligibility. So, while we don’t guarantee approval, we make sure that our recommendations filter out automatic denials based on these rules.

The newest feature of the CardGenie is the Bonus Eligibility Tracker. This feature will alert you when you become eligible for another sign-up bonus for a card you currently have (on your Active list) or a card that you’ve had in the past (on your Inactive list).

This feature is only eligible for Chase cards right now. This feature will track the general application rules for Chase, but also track the rules in place for specific cards, i.e. Chase Southwest cards or Chase Sapphire cards that do not allow you to get other cards within the same family.

How to know when you become eligible again.

If you’ve opted in to emails, then you’ll also receive an email notification about the new sign-up bonus eligibility for your cards.

Note: 5/24 rules apply to all Chase cards to be approved. Even if you are eligible for a new sign-up bonus for a specific card, you will not receive an email until you are under 5/24. What is the 5/24 Rule? With most Chase cards, you won’t get approved if your credit report shows 5 or more cards opened in the past 24 months. This is why we have a 5/24 counter on your card dashboard. More info here.

More Information

Based on the opened dates of your cards, you may become eligible to get a new sign-up bonus for a card you currently have or have had in the past.

With most Chase cards, there is something called the “24/48 Month Rule.” You can get the same card and bonus again 24 months after having received the bonus AND as long as you no longer have the card open. With Sapphire cards, you must wait 48 months.

If you currently have a card open, you will need to either cancel or downgrade this card to be eligible for a new sign-up bonus when that time comes. If and when you do become eligible again, you will need to wait 30 days after canceling or downgrading the card before applying again. This allows time for the previous card to clear out of Chase’s systems.

If the card is a Sapphire, you must downgrade to a different product family such as the Chase Freedom or Chase Freedom Unlimited. If you downgrade to the no annual fee Chase Sapphire, then you will not become eligible again for any Sapphire card.

If the card is a Southwest card, you must cancel or downgrade to a non-Southwest card in order to become eligible again. This can be hard to convince the Chase rep to do. If Chase will not allow you to do this, your only option is to cancel the card. If it’s one of your oldest cards, then it could impact your credit history. Also note, Chase will only approve you for one Southwest personal card and will not approve you if you currently have any other Southwest personal cards (Plus, Premier, or Priority).

Need to cancel or downgrade? Call the number on the back of the card. Then, set a calendar reminder for 31 days later to apply. Then, make the change on your Travel Freely Card Dashboard (Find the card and then click the pencil to edit the card. Scroll down and change the “Status” from Active to Cancelled or Changed.)

How This Impacts Your Points

- If your card is a co-branded card (Southwest, Hyatt, United, etc.), your points are already with that rewards program. You will not lose your points if you cancel or downgrade your card.

- If your card earns Ultimate Rewards (Sapphire, Ink, or Freedom card), then canceling or downgrading your card could mean losing your Ultimate Rewards points. At the time of writing, Chase allows 30 days for you to use them after canceling your account. So, if you have a lot of points in your account and don’t have a use for them, you may want to keep your account open right now. If you have another account with Ultimate Rewards, consider transferring all of your points to that account before canceling or downgrading.

Keys to Remember:

- Your 5/24 number must be under 5 in order to be approved for a Chase personal or Chase business card

- While Chase technically allows for 2 approvals in a 30-day window, it can drastically increase your approval odds to wait 90 days since your last application to apply for a new card.

- If your card is currently open, you need to wait 31 days after making your change before applying again.

What is the 5/24 rule?

With most Chase cards, you won’t get approved if your credit report shows 5 or more cards opened in the past 24 months. This is why we have a 5/24 counter on your card dashboard. More info here.

Why wait 30 days?

Once you downgrade or cancel the card, you’ll need to wait 30 days. This is recommended because it can take up to 30 days for this card to clear your credit profile. It needs to be cleared before you can apply for the card again. Otherwise, Chase will still think you have the card.

Confused? Let us help you if you have any questions. =)