The Best Credit Card Offers for Carrying a Balance

Citi is a partner of Travel Freely.

0% introductory APR credit cards offer new cardholders 0% interest for a period of time—which makes them appealing to those who are looking to offset the cost of large purchases or balance transfers.

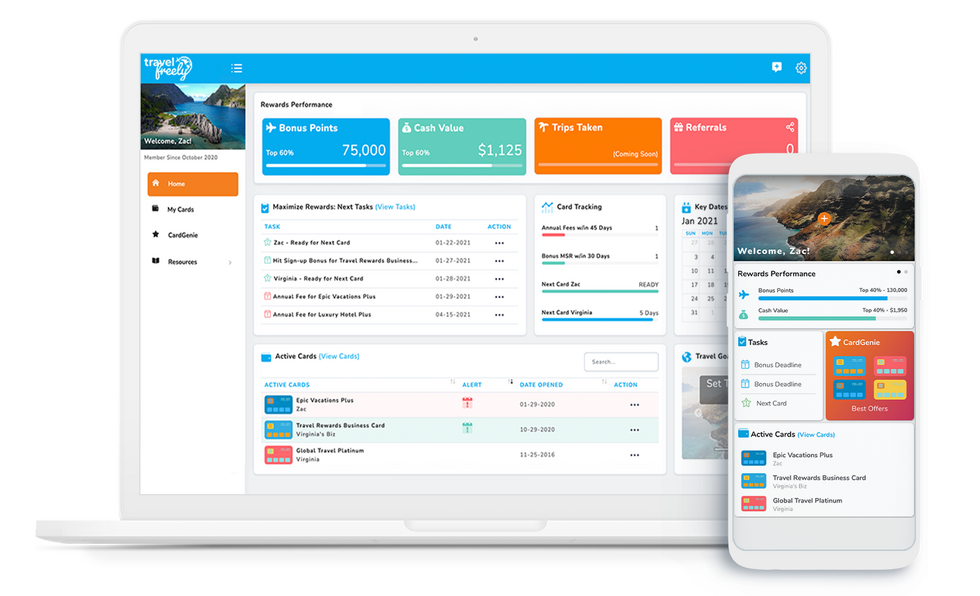

When it’s time to decide which card to open, we’ve simplified things with our “Best Of” rankings for the best credit cards for carrying a balance. If you don’t have time to research cards, take advantage of our expertise!

Our Top Recommendations

Best cards for Carrying a Balance and Balance Transfer: If you’re looking for the best balance transfer options, think about the Citi® Diamond Preferred® Card for a balance transfer and 0% on purchases option. The next best option would be the Citi Double Cash® Card. Also, almost all balance transfer offers still include a fee for the actual transfer. Make sure to read the terms for all cards before signing up.

Note: You will not earn rewards for the actual balance transfers. Make sure to check terms when applying. For cards that are great for carrying a balance, check out the Amex Blue Cash Everyday or Chase Freedom Unlimited® because they also have a welcome bonus.

Best Business Cards for Carrying a Balance