January 2026: Best Travel Credit Card Offers

Citi is a partner of Travel Freely.

We’ve simplified things with our “Best Of” rankings for best credit travel reward credit card offers available right now. Instead of researching dozens of rewards cards, you can use our expert recommendations to confidently choose the best option for earning free travel.

Travel Freely’s focus is simple: help you earn more points and miles in less time, using your everyday spending, so you can travel more (for free =) ).

How to Choose a Card (and When to Apply)

This page is designed to help you choose the right travel credit card.

Below, you’ll see the best current offers. We highlight the strongest offers first, including those that may not be around long.

You don’t need to understand every detail about points and miles to get started because we’ve already done the work for you. =)

What to look for:

- A strong welcome bonus

- A spending requirement you can comfortably meet

- Points that work for how you travel

Once you find a card that fits, timing matters. Credit card offers change often, and some disappear without notice. If you’re ready, its usually best not to wait.

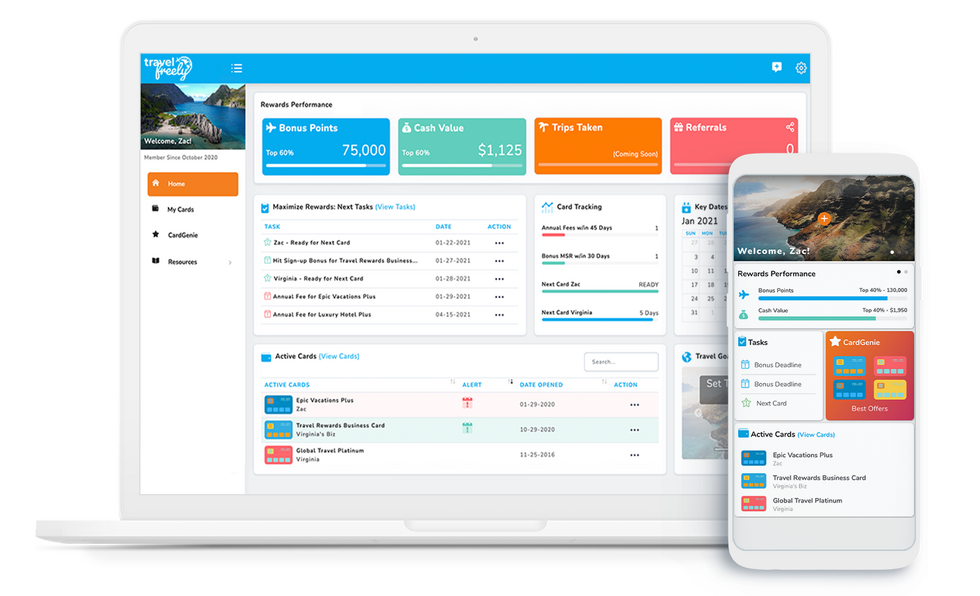

Want personalized recommendations? Log in to your Travel Freely App (it’s free!) and let the CardGenie® work its magic.

Top Travel Credit Card Offers Right Now (January 2026)

Still Going Strong! American Express® Gold Card – As High As 100,000 Points + 4x on groceries

The popular American Express® Gold Card has an “As High As” 100,000 point offer when you spend $6,000 within the first 6 months of card membership. (Welcome offers vary, and you may not be eligible for an offer.) It’s a crowd favorite for everyday spending thanks to 4x points on grocery spending (on up to $25,000 in purchases per year) and 4x at restaurants worldwide, including takeout and delivery in the US (up to $50,000 per calendar year in purchases.) (Terms apply.)

What’s really cool about this offer is Amex’s new “As High As” feature, which lets you see the maximum welcome offer you might before applying, with no impact on your credit score. This is one of the few times you can see your top-tier offer upfront — totally risk-free. Check out our Walkthrough Guide explaining how “As High As” Offers work.

This feature is also available for the American Express Platinum Card® with its As High As 175,000 point offer for $8,000 spend within the first 6 months of card membership (Welcome offers vary, and you may not be eligible for an offer.) Read more about why we like the Amex Platinum card here. (Terms apply.)

Increased Offer: Chase Sapphire Preferred® Credit Card — Our Top Beginner Card (75,000 Points)

If you’re new to points and miles, the Chase Sapphire Preferred® remains our #1 recommendation for beginners and one of the easiest cards to start with. If you want flexibility and value – especially if you aren’t sure yet what kind of free travel you want- the Chase Sapphire Preferred® is an excellent option.

👉 Check out the 6 Reasons Why We Love the Chase Sapphire Preferred® and learn how Chase Ultimate Rewards® can be used for everything from domestic and international flights to hotels and rental cars.

With its current increased offer, it’s an even better time to apply. Right now you can earn 75,000 Chase Ultimate Rewards® points for $5,000 in spending in the first 3 months. The bonus is worth over $750 in free travel.

🔥 Big Bonus, Premium Travel Perks: Citi Strata Elite℠ Card (100,000 ThankYou® Points)

Citi just rolled out a limited time offer on the Citi Strata Elite℠ Card: 100,000 ThankYou® Points after you spend $6,000 in the first 3 months of account opening. That’s enough points for flights to places like Hawaii or Europe, or even premium seats on longer trips when used strategically.

This card has quickly become a favorite thanks to its combination of flexible points, strong earning rates, and useful perks. You get access to a broad lineup of airline transfer partners (including American Airlines®), along with lounge access, hotel credits, and everyday benefits that can help offset the annual fee.

If you’re looking for a premium travel card with real-world usability, this one is well worth a closer look.

Check out our complete Citi Strata Elite℠ guide to see how it works and who it’s best for.

🔥 Our #1 Business Card: Chase Ink Business Preferred® Credit Card

The Chase Ink Business Preferred has become the best overall business card right now with a great bonus of 100,000 points for $8,000 spend in 3 months. With 3X categories like travel, shipping, internet, cable, phone, and social media advertising (up to $150k spend per year), it’s hard to beat the Ink Business Preferred if you’re looking for an all-around business card that has flexible redemption options and can be combined with your personal Chase Ultimate Rewards points. Points are also worth more when redeemed through the Chase Travel℠ portal using Points Boost.

🔥 Big Bonus, Big Spend: Amex Business Platinum Card® (200,000 Points)

This is not a beginner card for most people – but if you run a business with very high expenses, it’s worth knowing about.

The Business Platinum Card® from American Express supercharged its welcome offer with 200,000 Membership Rewards® points after you spend $20,000 in the first 3 months. (Terms apply)Making the welcome bonus alone potentially worth $3,000+ if used strategically.

Important Note: In the past, this offer has been a “targeted” offer where you may or may not be eligible. This offer is 200,000 points for EVERYONE and is NOT an “As High As” offer.

Offer Ends 1/15/26 at 9am: Chase Freedom Unlimited® (30,000 Points)

The Chase Freedom Unlimited® is running an elevated offer for $300 cash back after $500 in spending in the first 3 months. Although it’s marketed as cash back, you actually earn 30,000 Chase Ultimate Rewards® points. When paired with, the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®, those points can be tranferred between cards to access transfer partners for even more value.

With 1.5x points on every purchase and no annual fee, this is an easy, beginner-friendly card to add to your wallet.

Best Travel Credit Card by Situation

This section is a quick decision shortcut. If you already know what kind of traveler you are, start here and jump straight to the card that fits.

- Best for Beginners: Chase Sapphire Preferred® Card (75,000 points)

- Best for a Simple, High-Value Card: Capital One Venture Rewards Credit Card or Capital One Venture X Rewards Credit Card

- Best for Groceries & Dining: American Express® Gold Card (“As High As” 100,000 points)

- Best for No Annual Fee: Chase Freedom Unlimited®

- Best Business Card: The Business Platinum Card® from American Express (200,000 points)

- Best No Annual Fee Business Card: Chase Ink Business Unlimited® or Chase Ink Business Cash® Credit Card

- Best Airline Business Card: United℠ Business Card (75,000 bonus miles + 2,000 PQPs)

- Best Hotel Personal Card: Chase Marriott Bonvoy Boundless® Credit Card

- Best Hotel Business Card: Chase IHG® Rewards Premier Business Credit Card or Chase World of Hyatt Business Credit Card

- Best Cash Back Personal Card: Chase Freedom Unlimited® or Citi Double Cash® Card

- Best Travel Card for 3x on Gas, Grocery, and Dining: Citi Strata Premier® Card

- Best for Premium Travel Perks: American Express Platinum Card® (As High As 175,000 points + more perks) or Chase Sapphire Reserve® (125,000 points) or Capital One Venture X Rewards Credit Card

- Best Premium Hotel Card: Marriott Bonvoy Brilliant™ American Express® or American Express Hilton Honors Aspire

- Best Ultra-Premium Business Card: Sapphire Reserve for Business℠ (200,000 points) or The Business Platinum Card® from American Express (200,000 points)

- Best for College Students or Recent Grads: Discover It Student

- Best for Carrying a Balance: Blue Cash Everyday® Card from American Express or Citi Double Cash® Card

- Best Business Cards for Carrying a Balance: Chase Ink Business Unlimited® Credit Card orChase Ink Business Cash® Credit Card

- Best Travel Cards for Carrying a Balance: Chase Freedom Unlimited®

- Best for Balance Transfer: Citi® Diamond Preferred® or Citi Double Cash® Card

Beginner Mini-Webinars & Strategy Resources:

These resources are optional and meant to support your decision — not slow you down.

Watch (Short Videos)

Chase Ink Business Cards Most People Shouldn’t Ignore

Long-term keepers worth knowing about in almost any card setup.

These Chase Business Cards are ones that people consistently come back to because they’re useful, flexible, and easy to keep long-term. That’s why we keep them visible here — so they stay on your radar even if you’re not applying today.

Quick Eligibility Note (Updated November 2025): Chase has added eligibility pop-ups on the no-annual-fee Chase Ink Business Unlimited® Credit Card and Chase Ink Business Cash® Credit Card.

Ink Business Preferred® Credit Card (Updated November 2025): The new cardmember bonus may not be available to you if you have previously had this card. Chase may also consider factors pertinent to your business in determining your bonus eligibility.

If you’re not eligible for the welcome bonus, you’ll typically see a notice before a hard credit check, which helps avoid surprises.

This card has a great signup bonus and 3X categories. It’s hard to beat this Chase Ink card. Especially when you’re looking for an all-around business card that has flexible redemption options. Also, it can be combined with your personal Chase Ultimate Rewards points. Learn more about this card with our Chase Ink Business Preferred Complete Guide.

- Earns 3X rewards on travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year)

- Points worth more when using Points Boost in Chase Travel℠ portal or when transferred to partners

- Cell phone protection against theft or damage

- No foreign transaction fees

Great signup bonus for a business card with no annual fee. Great for carrying a balance. 5x earning categories, and if paired with a premier Chase credit card (one that carries an annual fee), your points are worth even more.

card. An excellent companion to the Ink Business Preferred® Credit Card, Sapphire Reserve for Business, personal Sapphire Reserve or personal Sapphire Preferred. Like the personal Sapphire cards, this card earns valuable Chase Ultimate Rewards. To learn more about this card, check out the Chase Ink Business Cash Complete Guide.

- Earn 5X rewards (on first $25k spent each account anniversary) for phone, TV, internet, and office supply stores.

- Earn 2X rewards on gas and restaurants (on first $25k spent each account anniversary)

- No Annual Fee

An all-round great no-thinking business card with no annual fee. It’s very simple. You earn unlimited 1.5 points per $1 spent on all purchases. This can be a great standalone card, but it is an excellent companion card to the Ink Business Preferred® Credit Card, Sapphire Reserve for Business℠, Sapphire Reserve, or Sapphire Preferred since you can combine your points under one of these cards which allows point transfers to Chase’s transfer partners. For more on this card, check out our Chase Ink Business Unlimited Complete Guide.

- Earn 1.5X rewards on Everything

- No Annual Fee

| Card | Signup Bonus | Spending Required | Annual Fee |

|---|---|---|---|

| Ink Preferred | 100,000 Chase Ultimate Rewards points | $8,000 in first 3 months | $95 |

| Ink Unlimited | $750 | $6,000 in first 3 months | $0 |

| Ink Cash | $750 | $6,000 in first 3 months | $0 |

New to Business Cards?

You don’t need a large company or formal LLC to qualify. Many freelancers and sole proprietors are eligible for business credit cards.

Our Top Recommendations for Carrying a Balance

For readers prioritizing balance management or debt reduction this year.

If you’re looking to carry a balance, think about the Citi® Diamond Preferred® Card. The next best option would be the Citi Double Cash® Card. Note: You will not earn rewards for the balance transfers. Make sure to check terms when applying.

For great introductory offers, check out the Blue Cash Everyday® Card from American Express or Chase Freedom Unlimited® because they also have a welcome bonus.

Best Business Cards for Carrying a Balance

Special Guide for Business Owners

What’s Our Criteria for the Best Cards?

- Value of points

- Strength of signup bonuses

- Type of card (airline, hotel, transferable points, etc.)

- Reasonable spending requirements

- Ease-of-use & hidden fees

Want personalized recommendations? Log In to your account to see your CardGenie® Recommendations.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.