You Earned Your First Credit Card Bonus… Now What?

You read about free travel using frequent flyer miles from credit card sign on bonuses. You realized how great of an opportunity this was. So you opened your first credit card, met your minimum spend, and now you have earned your first credit card bonus.

CONGRATULATIONS!!!

But now what? You may be feeling a little lost about what to do next. There are a few important routes to consider and a few details to keep in mind. Let’s look at them.

Do NOT Cancel Your Card

STOP! Do NOT Cancel That Card!

The first thing you should do is nothing. Many people think because they earned the bonus, they should cancel the card. Canceling your card is the worst move to make right after getting your first credit card bonus.

Banks don’t like when you cancel a card shortly after earning a sign on bonus. It hurts their bottom lines, and they are hoping you’ll run up a balance and pay interest on the card. While a smart Travel Freely reader would never do that, the banks want you to have the option.

You want to make the banks happy so that they will keep giving you lucrative sign-on bonuses. I’ve seen too many people get completely shut down by some banks for closing a card they’ve only had for 2 months. Don’t be one of those people. You’ve already paid the annual fee (or it was waived for the first year). Keep it open for a year. Then, you can cancel the card or product change it to a card with no annual fee.

Book a Vacation with your First Credit Card Bonus

You don’t want to hoard points and miles, so go ahead and book a vacation with your first credit card bonus. If you’re looking for inspiration, it is possible to book a family vacation with your first credit card bonus.

Traveling for free is why we do this, after all. Now that you have received your first bonus, use it for some awesome free travel. If you’re looking for some trips that real-life travel freely readers have made, we have shared some great success stories.

Open a New Card

If you’re not quite ready to book a vacation with your first credit card bonus, start looking into opening a new credit card. Earning another credit card bonus can help you book aspirational travel faster.

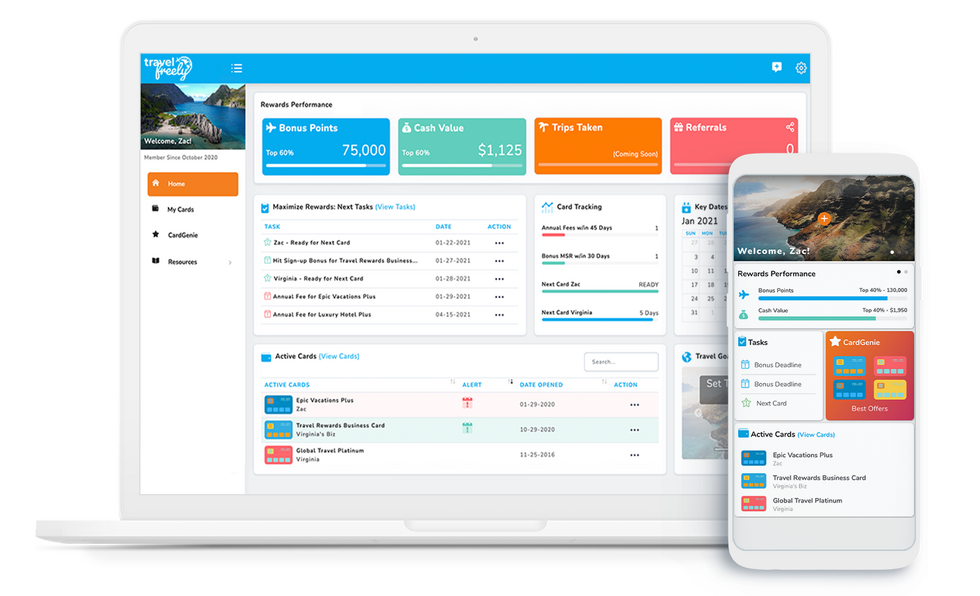

But since you just earned your first credit card bonus, go slow. If you don’t have very robust credit, a new application may cause a slight drop in your score. Use Travel Freely’s application timer to apply at the optimum time to get a new card and earn your next credit card bonus.

If you’re not sure what credit card to open next, check out our top credit cards page, but if you’re a Travel Freely user, make sure to log in and use your CardGenie® tool to get personalized recommendations. With the CardGenie®, we do the work for you. You don’t have to know all the different bank rules, such as your 5/24 status. You can be a lazy free traveler and get the rewards while avoiding the minutiae around points and miles.

Keep Old Cards Open

This one is a bit down the road, but you should be sure to keep old cards active. As you earn new bonuses, it can be easy to forget about some of the older cards you’ve had. It’s somewhat rare, but inactivity on cards could get your accounts closed. Normally the bank sends a letter with a warning that they will be close your card if you do not put any charges on it in the next few months.

Dust off the cobwebs of your old cards and keep them active.

You can easily avoid this by putting a small charge on your card every 12 months. I tend to put a small annual subscription fee on an old card, and then set it to auto-pay. This will keep older accounts in good status with the bank. The most important reason to keep these older cards is for your credit score to stay strong and stable. Keeping old accounts open will lengthen your average age of account. The older the card, the better your age of accounts.

Related Articles: