How to Maximize Your Credit Score

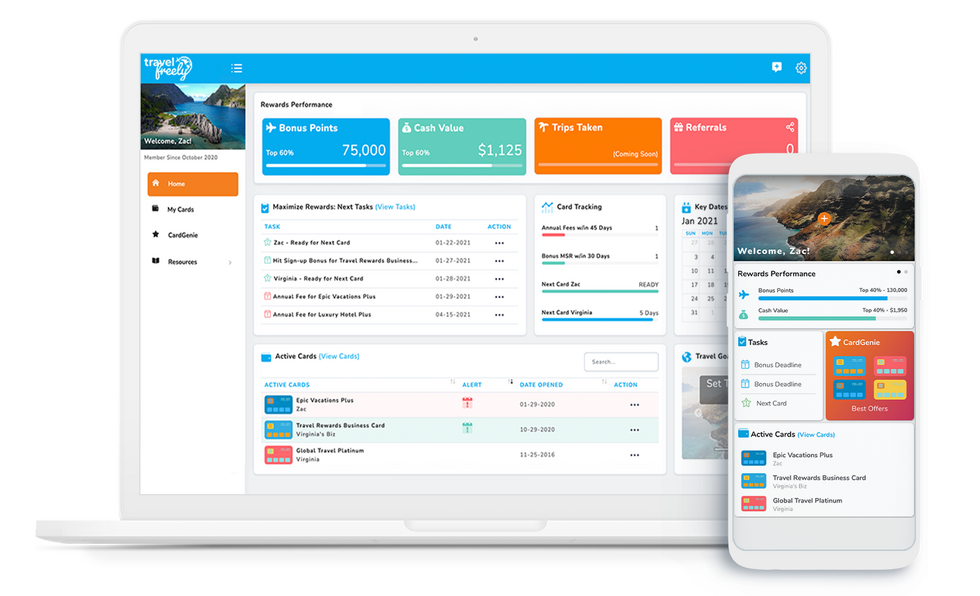

The large majority of Travel Freely members see their credit scores improve! Read How Free Travel Increases Your Credit Score to learn how this is possible.

Travel Freely has filtered through hundreds of articles and websites dedicated to this topic and condensed the information into just a few pages to save time and be sure you are doing the right things to increase your credit score. Enjoy, and keep track of how your score improves!

Just Getting Started? What this means for the cards you currently have in your wallet

We recently received an email from a Travel Freely member who asked us for our recommendation for what to do with her existing cards: “The thing I realized was that I have way too many store credit cards that don’t provide any perks. I also have a few major cards that do the same thing. How do I get rid of those cards to move on to my new travel goal without dinging my credit?”

It’s common for people to think they need to cancel all their existing cards to make way for travel rewards cards, but that couldn’t be farther from the truth. Canceling your current cards can cause a decrease in your credit score.

When getting started, the most important thing is to leave your oldest credit card(s) open, as this will help your credit score (this applies to any type of card, not just a store credit card!). It’s not a big deal if you keep a few of your cards open, especially if they have been open for a long time and don’t have an annual fee. Closing your oldest cards can really ding your credit.

Truthfully, it’s not a matter of how many credit cards you have open at the moment, but more so your overall credit limit. If closing a lot of your cards means lowering your overall credit limit, this can negatively impact your credit score.

In addition to keeping your oldest cards open, the other big factor is that banks scrutinize the most recent applications. Chase’s unofficial 5/24 rule states that they will not approve you for a new card if you’ve gotten 5 or more personal cards from any bank in the last 24 months. So, store credit cards can hurt if you continue to open them.

Keep reading for an in-depth look at how your current cards help to boost your credit age and overall credit score!

Commitment is Key

Before we tackle specific ways to increase your credit score, it is important to make the commitment to financial prosperity through disciplined spending and on-time bill payments. This is an easy decision because of short and long-term payoff. In the short term, you’ll take control of your spending and feel empowered by improving your financial position. In the long term you will be able to:

a) Get approval for car loans, home loans, and other credit approvals;

b) Save thousands of dollars with better interest rates on these loans and

c) Earn free travel through rewards, credit cards, and spending bonuses.

However, if you have had spending problems in the past or cannot be certain that you are ready to spend only what you have, you need to wait until your finances improve or you have proper budgets in place before opening any credit cards. As you will see below, you only have to make a small monthly purchase to increase your score.

How to Begin Building your Credit History

To build a credit history, you have to have credit. If you don’t have any cards or accounts, beginning with one or two easy-to-manage accounts is important. Remember, debit cards and cash payments do not establish or help your credit. You can only build your credit by having credit. So, even if it means getting a secured credit card, you must start the process. You can still use your debit card and cash for your expenses, but adding at least one card will establish a credit history and get you on your way to future loans and free travel.

Let’s learn how to improve your credit score by each credit factor.

Improving Derogatory Remarks

This is great news if you have a “0” on your Credit Karma report under this category! Let’s keep it that way. There’s no reason to receive any derogatory remarks in the future if you are aware of your finances and pay your bills on time. If there are any remarks, use your Credit Karma app to research what they are and verify them. If they are unfamiliar to you, you may need to dispute them with the credit bureau to remove any misinformation.

Improving Your Payment History

Your payment history should be 100% for everyone in good standing. If it is not, do some research to verify that all the information is accurate. Be sure to dispute anything that is not accurate because this can significantly affect your credit score.

Keeping your payment history at 100% is simple: Make all of your payments on time! This means paying off the Statement Balance when your monthly statement becomes available. You do not have to pay off the current balance (you can do so if you want) because the more recent charges will appear on the next statement balance. Also, you want to ignore the Minimum Payment Due because this means you will carry a balance and pay interest — this is never recommended. Making all your payments on time ensures that you will never pay any late fees or interest on your cards.

If you do forget a payment and see a glaring “LATE” note on your account… Don’t panic. You need to know that credit card companies do not report late payments immediately. On average, it takes 60 days for a late payment to be reported. So, if you forget to make a payment, do these steps:

1) Make the payment ASAP; and

2) Call the number on the back of your card and tell them the situation. Ask them to remove the late fee and any interest charged. Remind them that you are a good customer and this has not happened before. Without much hassle, most companies will gladly remove these fees. You do not need to make up a story or act apologetic; it’s routine for them to do. This is good news when things get busy, and you forget to pay.

Here’s a little tip for those still wanting to use debit and cash for their expenses. You must make one monthly payment on the card to establish a good payment history. So, if you are not wanting to manage a card, consider this easy system: Put a recurring subscription such as Netflix or Hulu on this card. Then, set up the card to be paid off with autopay through your checking account. Just like that, you’ve got a 100% payment history established, and you don’t have to think about anything!

Improving Your Credit Card Utilization (CCU)

Your CCU is the total balance on your cards divided by the total amount of available credit. For those with few accounts, keeping your balances low and being aware of your credit limits is important. It is good to have a low CCU (and bad to have a high CCU). This will fluctuate based on when you pay your bills. The higher your available credit, the easier it is to have a good CCU. Just be careful not to get too close to your limits, as this can negatively impact you.

When starting out with one or two cards, your credit limit may be very small, between $200-500. The credit card company wants to ensure you can be responsible for a small amount. However, after 3-6 months of an account being opened, it is a good idea to call the number on the back of your card and request a credit limit increase. This will raise your credit limit and make sure your CCU is always at a good, low percentage. This action alone will raise your score.

Also, when applying for new cards, applying 1-2 weeks after your cards are paid off is good. For example, if you pay your cards off on the 5th of the month, try applying for cards between the 12th and 19th, when your CCU will be reported as low.

Remember that having more credit available will make you more attractive to credit card companies and banks. It is one of those counter-intuitive facts about credit reports.

Improving Your Age of Credit History

As noted above, your Age of Credit History is the average length of all your accounts. Fortunately, this is not a major factor in your credit score, but it does play a role. There are three important things to remember here:

1) Always keep your oldest accounts OPEN. It is to your benefit to have old accounts. The longer your credit history, the higher your score will be. Many people think it’s good to close accounts they no longer use. This is not true! So even if there is an account from a credit union way back in college, you want to keep it open to benefit from that long history. It will help out your average account age when opening new cards.

2) If you want to close an old account because it has an annual fee, call the number on the back of your card and ask them if you can “Downgrade” your card to one with a $0 annual fee. This will keep your account open and will not count as a credit inquiry! The other possibility is negotiating with the company to lower your fee or credit your account; sometimes, this is possible if you are a long-term customer. When closing or downgrading, always remember to have a $0 balance so you do not hurt your score.

3) If you open an account and decide 24-48 hours later that you don’t want it, it is best to keep it open. You have already caused a hard inquiry, and it will look bad if you immediately close an account. Keep the account open unless the company says it can be reversed. So, ensure you are ready to open an account before you do so.

Improving Your Total Accounts

You may have several accounts even if you don’t have any credit cards. These accounts could include current or previous car or home loans, cable bills, cell service, etc. If you have been added by a spouse, friend, or family member as an authorized user, you may also have their account listed here. If this is the case and you are an authorized user, the account details will show this when you click on the account description.

If you have a few accounts, we will get you started with some basic credit cards, but you also want to consider if you can become an authorized user of someone else’s account. Becoming an authorized user does NOT make you responsible for payments or balances. Becoming an authorized user allows you to be part of a primary cardholder’s account and benefit from on-time payments made by the primary account holder. This will increase your score, though not as much as being a primary account holder.

Ideal Scenario: Believe it or not, the credit bureaus give an Excellent rating to people with 21 or more accounts! This may seem like a lot, but multiple credit cards, loans, and other lines of credit can add up quicker than you think. This does not mean you need to open loads of accounts. It shows that the credit bureaus see many accounts as a good thing.

Improving Your Credit Inquiries

This is also a low-impact factor, but it is important to keep these to a minimum. The two words you need to know here are: “hard” and “soft.” These are the two types of credit inquiries. As noted above, hard inquiries will appear on your credit report for up to two years. Soft inquiries will NEVER show up on your credit report. Hard inquiries are made when you apply for credit cards, home or car loans, or any other type of credit like cell or cable service. Soft inquiries are made by companies when trying to get you certain offers or by software like Credit Karma. These soft inquiries do NOT affect your credit score. It is important to avoid hard inquiries as much as possible.

Just an extra note: Some “credit experts” make a big deal of the fact that opening new accounts can negatively impact your score. A new account can lower your score because of a hard inquiry, but it is temporary and just a few points. Your score will go back up and most likely increase just a few weeks later.

Now, if you are in the middle of getting a home mortgage or car loan, your banker does not want to see any change to your credit activity. If so, delay opening any cards until these loans are finalized.

Also, auto or home financing companies sometimes shop around for the best rate. You want to be extra careful that they are not giving them free rein for multiple credit inquiries. Make sure to ask if they will be doing hard or soft inquiries. Any soft inquiry is fine, but some car dealerships are known to ring up 5-10 inquiries as they search for the best loan and then charge you extra for this service!

Finally, if you want to be diligent about your credit score, make sure you are tracking your FICO score. Services like Credit Karma can help you monitor details of your credit report and monitor credit factors but remember they are a for-profit company. When it comes to your actual credit score, they often use a VantageScore, not your FICO score. While VantageScore can offer some insights, it seems to be used mostly by companies who look to sell additional products and services.

One thing I’ve noticed over the years is that the VantageScore tends to fluctuate a lot more than the FICO score. It’s completely normal for your credit score to fluctuate, especially after opening a new credit card. But these changes are usually temporary, fairly minor (a few points), and the vast majority of people see their score come back to meet and exceed their original score over the span of about 90 days.

Therefore, for a more accurate score based on real FICO calculations, use Experian’s free credit score service. The scores are more accurate than Credit Karma. And, as I mentioned in the link, it’s FREE.