Member Success Story: Honeymoon in Greece from Small Business Expenses

Tell us a bit about yourself. How long have you been using points and miles towards free travel?

My name is Rob and I live in Baltimore, MD. I am married and have 2 children, 1 boy and 1 girl. I am a personal trainer with 9 years of experience, and I own a personal training business. I have been using credit card points for over 6 years, allowing me to book my honeymoon and many other trips.How did you get started with points and miles?

Like most business owners who are first getting their business off the ground, I had to make large upfront purchases for things like a cable machine, flooring, SEO marketing, and building my website, costing me several hundred to several thousand dollars per purchase. I had heard about credit card points, so I opened a business credit card to make these purchases on it. I hit my minimum spend quickly and began accumulating quite a few points in my account. This prompted me to look into how to redeem these points for the most value, which opened this pandora’s box of opportunity!

Please tell us about your favorite trip. Where did you go?

My wife and I traveled to Greece for our honeymoon! We spent 3 nights in Athens, 4 nights in Santorini, and 4 nights in Crete. Aside from eating nonstop gyros, we enjoyed the history of Athens, Santorini’s beauty, and Crete’s peacefulness. Crete was our favorite because it was less touristy than Santorini. We rented a car and explored the island, enjoying different beaches and attractions.

Can you share a vivid memory of a specific moment on your trip that brought a huge smile to your face?

Absolutely! My wife and I are huge Baltimore Ravens fans. We were at a soccer bar in Crete, and the owner insisted he put on the Ravens game for us. The best part was that the bar was closing for the night, so instead of kicking us out, he poured us several beers, left the TV on, and told us to turn off the TV and close the door behind us when the game ended! I will never forget this experience due to the owner’s generosity and how comfortable he made 2 strangers feel; it was an excellent experience!

How much money did you save using points and miles for your trip?

Aside from our ferry ride and 2 nights in Santorini, we booked our entire trip using credit card points. That includes our flights AND hotels! We saved thousands of dollars on our trip by using points.What kind of points did you use for this trip?

We used Chase Ultimate Rewards points to fund the trip. I have the 2 Chase Ink Business cards without an annual fee, the Ink Business Cash® Credit Card and the Ink Business Unlimited® Credit Card. I combined those points with my 2 Chase Ultimate Rewards-earning personal cards, the Chase Sapphire Preferred® Card and the Chase Freedom Unlimited®. On top of that, my wife is my Player 2, so she also has her own Chase Sapphire Preferred and Chase Freedom Unlimited cards. And since you can pool your points with someone else living in the same household, we were able to pool her points with mine.

What other trips have you been able to take your family on since you began using points and miles?

We took a 9-day trip to Maine. We flew to Portland, drove to Bar Harbor, and then went to Moosehead Lake. We used points to cover our flights and then one of our cards at the time had a special with Airbnb, where we used points to cover a portion of our stay. We also went to Pensacola, Florida, using our Hilton cards from American Express. That covered our entire hotel stay for 4 nights and 5 days. We recently used Southwest credit card points to cover all 4 of our flights to Disney this December.What advice would you give someone interested in using points and miles to book trips like yours?

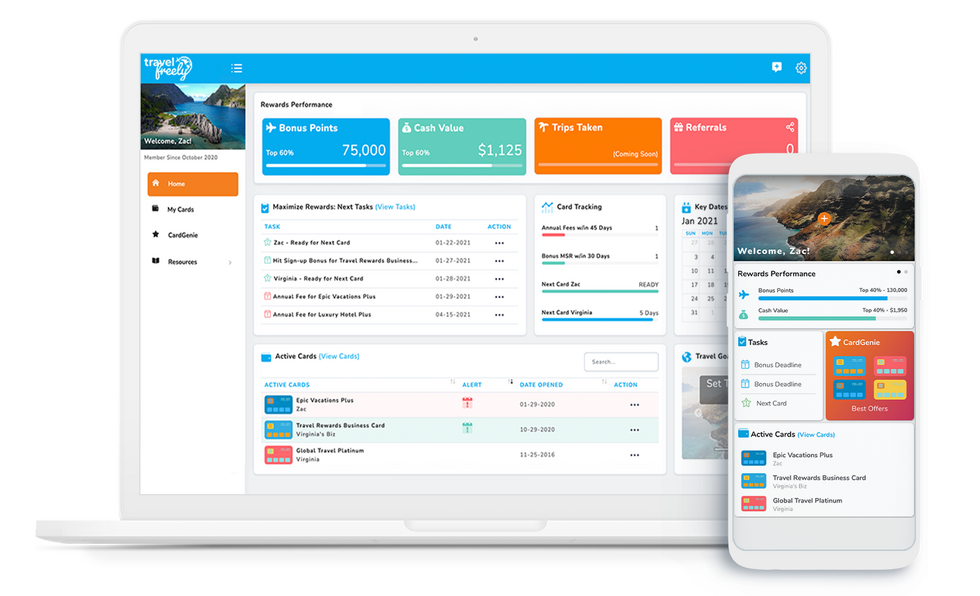

The most important thing to remember is to make sure you have a reason to use the credit card in the first place and that you can pay it off. As a small business owner, I seek a new credit card signup bonus when purchasing large exercise equipment. For instance, I recently purchased a new resistance cable machine for my gym. I knew I would spend $2k on the machine, so I opened a new credit card and hit the bonus with the purchase. I do this with personal expenses as well. For example, when we bought our first home, we knew there would be many large expenses, like purchasing furniture, moving costs, etc. So, knowing that we were about to spend quite a bit of money, we took advantage of credit card signup bonuses to increase our stashes of points. In fact, anytime I am about to make a big purchase, I stop to think about whether I am eligible for a new personal or business card (depending on the type of expense). Conveniently, Travel Freely’s CardGenie® takes the guesswork out of determining eligibility and which cards to consider! Trying to open and organize so many credit cards can become overwhelming. I have more credit cards to manage than the average person, but Travel Freely has made managing those cards easy for me! I can log into the free app anytime to see which cards I currently have and a listing of any new credit card signup bonuses I can take advantage of. I also receive alerts to my email and phone telling me when I am eligible to open a new card and when I have a credit card annual fee coming up. It’s nice to have everything in one place!

In Summary

It is exciting to see our members achieve their travel dreams while pursuing their professional dreams. Do you have a business with the potential for earning points and miles which can help you fulfill your travel aspirations?

👉 Inspired by Rob’s story? Start tracking your cards with Travel Freely today – it’s free, beginner-friendly, and built to make stories like this possible. Have a success story you’d like to share? We’d love to hear it! Reach out to us at or fill out our form here.