Q&A on Chase Ink Business Cash®Credit Card & Chase Ink Business Unlimited® Credit Card Increased Offers!

🌟 Gold Alert: Update 9/12/25: Both the Chase Ink Business Cash® Credit Card and the Chase Ink Business Unlimited® Credit Card are offering $900 cash back (equivalent to 90,000 Chase Ultimate Rewards® points) for $6,000 spend in the first 3 months.

These offers on no-annual fee business cards are incredible, so these cards should absolutely be at the top of your list. For more information on these cards and their offers, click here.

The Chase Ink Business Cash and the Chase Ink Business Unlimited are our #1 and #2 ranked business cards. There are many reasons for everybody to have these cards in their wallet.

The biggest reason to be excited about these cards is the $900 cash back offer (90,000 Chase Ultimate Rewards points). Another reason is that you can combine the points you earn from these cards with Sapphire personal cards for maximum value.

We’ve put together responses to the most commonly asked questions regarding eligibility for the no-fee Ink Cash and the Ink Unlimited cards here. If you’re not sure whether you qualify for a business card or not (Hint: you probably do!), check out our article: Am I Eligible For a Business Credit Card?

Special note: If you have had either of these cards before, it is important to read through this article to make sure you qualify or understand how to qualify. Here’s the breakdown:

To qualify for the Ink Business Cash or Ink Business Unlimited’s increased bonus, you must meet the following criteria:

- Under 5/24: If your credit report shows that you opened 5 or more new cards from any card issuers in the past 24 months, then you will not be approved for a new Chase card.

- No Ink Business bonus for the same card and the same business in the last 24 months: For example, if you received a welcome bonus for the Ink Business Cash/Unlimited in the past 24 months for the exact same business, then you are not eligible for this bonus.

- Not currently have the card: You can’t currently hold the card for the business you want to apply for.

- Qualify for a $5,000 credit line: Chase won’t approve your application unless they see fit to allocate a $5,000 credit line or more to your new account. Note that if you are a current Chase customer with other business cards, they will usually be open to moving credit from other existing business cards in order to open the new account if needed.

- Meet minimum spend requirements: Once you are approved for the Ink Cash or the Ink Unlimited, you have 3 months to make purchases totaling $6,000 or more. Keep in mind that charges that count as cash advances and any other card fees you incur do not count toward that total, including the annual fee.

Questions and Answers About These Increased Offers

How do I apply?

Learn more about these offers and how to apply here (Thank you for your support of Travel Freely!):

And for help filling out the application, we have the perfect guide here: How to Apply for a Business Credit Card.

How much are 90,000 Chase Ultimate Rewards points worth?

The answer depends on how you use the points:

- $900 cash — You can directly cash out your points for a penny each.

- $900+ towards travel — If you have a Chase Sapphire Reserve® personal card, you can transfer your points to that account and redeem for up to 2 cents each when you use points to book Points Boost eligible flights or hotel stays in the Chase Travel℠ portal.

- $1,350 or more towards travel — Chase Ultimate Rewards points can be transferred to a number of travel partners (see details here). In many cases, if you know what you’re doing, it’s possible to get far-outsized value for your points this way. Here’s just one example: The Park Hyatt St. Kitts Christophe Harbour usually charges $1,000 or more per night. Alternatively, you can pay 30,000 Hyatt points per night for the same stay in a standard room with beachfront views (during standard night pricing). Since you can transfer Chase points to Hyatt at a 1 to 1 ratio, you could move 90,000 of your Chase points to Hyatt and then book 3 nights at the Park Hyatt St. Kitts (worth over $3,000) with those Hyatt points. Even better, Hyatt doesn’t charge resort fees on free night award stays. Note: Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user on the account. Points can also be transferred to the loyalty account of a joint business owner, but they do need to be an authorized user on the associated business account.

How long will these offers last?

We don’t know. If it’s a special offer, then these offers seem to last 4-6 weeks.

What if I can’t spend $6,000 in 3 months?

Consider reading this article to get ideas for how to hit minimum spending requirements. Often, there may be regular expenses you are making that aren’t yet put on a credit card.

Important: Be careful not to overspend just to meet spending requirements on new cards. You should also be paying off your cards in full each month.

Otherwise, if that is too high, I would recommend staying away from these cards and looking at other options like the Chase Sapphire Preferred® Card personal card that only requires $5,000 in spending or the Capital One Venture Rewards Credit Card that only requires $4,000 in spending.

I applied and did not get an answer. It went pending. Is there anything I can do?

Yes! But, don’t call right away. Use our article here which shares some specific strategies on pending applications for Chase business cards. It’s normally much better to delay calling and wait when a Chase business card goes pending. This is to avoid a more thorough review of your application. And given time applications can end up approved!

I applied and was denied. Is there anything I can do?

Yes! When denied for a Chase card, call the reconsideration line (1-888-270-2127) to ask for the decision to be reconsidered. If you currently hold other Chase business cards, tell the agent you are not looking for more credit and you are happy to move credit from another card to open this one.

I recently applied for the lower offer. Will Chase match me to the higher offer if I ask?

Chase has been known to match signup bonus offers in the past if they are public offers and within 90 days of a previous account opening. That said, there’s no guarantee. It also seems like people get denied if they ask within a few days of the new offer going live.

So, I would wait a few days. Then, go to your Chase online portal and send them a secure message with a screenshot of the new offer from chase.com. Mention the last 4 digits of the card so they can streamline the communication.

What are the rules on getting more than one Ink business card?

Chase Ink cards are all treated as separate cards. You can apply and get approved for more than one for the same business. It’s known that Chase only allows you to apply and be approved for 2 personal cards or 1 personal card + 1 business card per 30 days. The data points for 2 business cards in 30 days are varied. To err on the side of caution, I suggest a 30-day gap between Chase business card applications. So, with the latest Ink offers, you could potentially earn up to 180,000 points if you successfully go after both offers.

What are the rules if I have more than one business?

If you have multiple businesses, then you are eligible to get each of these Ink cards and a new signup bonus for each business you own. For a clear strategy on this, please read pp. 12-13 of our Travel Freely Small Business Guide here. Note that this does not guarantee approval, but it’s possible. For those with separate EINs, this strategy will work best. Anecdotally, it seems likely Chase will only approve you for one card if you are claiming multiple businesses using your SSN as the Tax ID for multiple businesses.

Chase card offer terms state: “I understand that any new cardmember bonus offers for this product are not available to either current or previous cardmembers of this product who received a new cardmember bonus for this product in the last 24 months.” Despite those terms, it’s very common for people to successfully sign up for more than one of the same Ink card across multiple businesses.

Tip: You can create an EIN for your business here for free in about a minute.

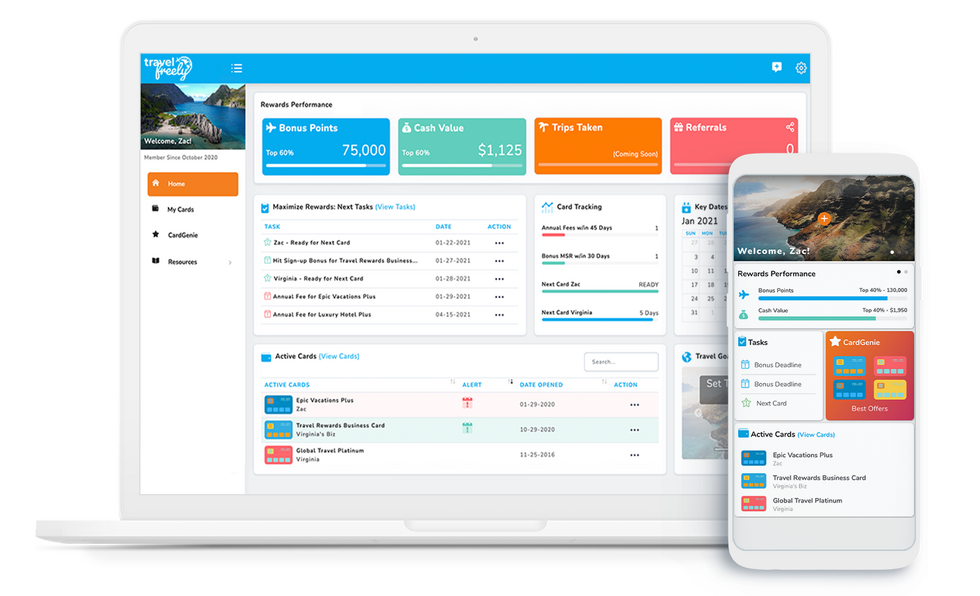

💡Pro Tip: If you have multiple businesses, the Travel Freely app allows you to create a separate profile for each of your businesses, all housed under one account, making tracking your cards across businesses even easier.

If I have a personal Chase card like the Chase Sapphire Preferred or Chase Sapphire Reserve, can I transfer the points I earn on my business card to my personal card?

Absolutely. You can transfer points to other Chase accounts you have or those who are household members or authorized users. Here’s a walkthrough on how to Chase merge points.

Can I earn the bonus by product changing to the Ink Business Cash/Unlimited from another Chase card?

No. You must open a brand new account.

5/24 Questions

How do I know my 5/24 status?

Good news! Travel Freely tracks this for you. Check your Travel Freely My Cards page. And read more here.

Does this card count toward my 5/24 status?

You must be under 5/24 to be approved. However, once you are approved, Chase business cards do NOT count toward your 5/24 count. e.g. If you are at 4/24, then you will stay at 4/24 after approval.

I am told I am over 5/24 due to being an authorized user on several accounts. Can I qualify?

Yes. Authorized user cards can cause initial denials. However, they do not count. You can call (1-888-270-2127) and talk to an application specialist and they will remove authorized user accounts when doing a manual review. Sometimes you’ll get customer service reps who try to tell you authorized user cards do count towards your total accounts, but the key is either to say, “No, I am not financially responsible for that account,” or to hang up and get another rep on the phone.

Current Ink Cash/Unlimited Card Questions

I currently have the Ink Business Preferred® Credit Card or Ink Business Unlimited card. Can I qualify for the Ink Business Cash? And vice versa?

Yes. Chase treats all of these Ink cards as individual products.

I currently have an Ink Cash/Unlimited card. Can I cancel it and then apply again?

Yes! But don’t cancel until you’ve either moved your points to another Chase Ultimate Rewards earning card or spent those points on cash back or travel or transferred them to Chase’s transfer partners. More details here.

After canceling, it’s best to wait at least a week before applying for the Ink Cash/Unlimited. And make sure you meet the other eligibility requirements like being under 5/24 and not having earned the bonus on the card in the last 24 months for the business you applied for.

I currently have an Ink Cash/Unlimited card but only because I’m an authorized user. Can I sign up for the Ink Cash/Unlimited?

Yes!

24-Month Rule Questions

I signed up for an Ink Business Cash/Unlimited a while back. How do I know if it’s been 24 months since I earned the bonus?

If you have Travel Freely, just check and see if the card you want is showing up on your CardGenie™! Or, look at the individual card info to see when you opened the card. I would add 28 months from the date opened if you want to be certain you are eligible for the card again. Otherwise, look at old credit card statements, simply call Chase and ask, or send Chase a secure message after logging into your account.

How long has it been since I earned my last Ink Cash/Unlimited bonus? I don’t remember.

If you have records of when you signed up for the card (check your Travel Freely My Cards page), you can estimate you received the bonus about 4 months after opening the account. That should give you a good enough timeline. If you don’t know when you signed up or you need a more precise answer, call Chase or send them a secure message to ask.

It has been more than 24 months since I received a welcome bonus, but less than 24 months since I canceled my Ink Cash/Unlimited. Can I qualify?

Yes. The 24-month rule is specific to the date on which you last received a welcome bonus for the Ink Business card you want to apply for again. It’s okay if you have recently had one of those cards as long as it’s been more than 24 months since you last received a welcome bonus.

I recently closed my Ink Business Cash/Unlimited in the last year, am I eligible?

See the question above. The 24-month rule has nothing to do with when you closed or product changed your previous Ink Business card. It is specific to the date on which you last received a welcome bonus for the Ink Business card in question.

I previously had an Ink Cash/Unlimited, but I never earned a welcome bonus. Can I qualify?

Yes. As long you have not received the welcome bonus within the past 24 months, you can qualify.

Is it helpful if I use Travel Freely’s link?

Yes! Using our Travel Freely links is the best way to support our site and app. Feel free to tell all your friends about this great offer too!

(Some of this content originally appeared on The Frequent Miler and has been posted with permission.)