Understanding Capital One’s Venture Family Card Application Rules (Updated 2026)

If you’re thinking about applying for a card from Capital One’s Venture lineup (Venture, Venture X, and VentureOne), it helps to understand a few key rules first. Understanding how Capital One handles approvals, welcome bonuses, and the timing of applications can save you headaches and help you earn more rewards.

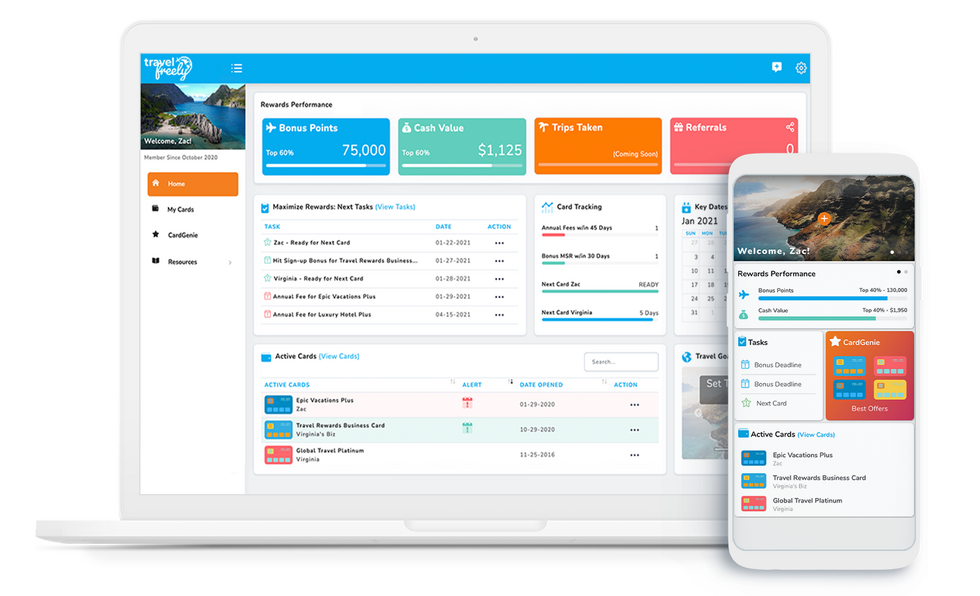

Or… you could skip this entire post and let the Travel Freely app do it for you. Seriously. If you use the app, you don’t have to keep notes on six-month rules, 48-month rules, or which bonuses you’ve already earned. We track it all for you and give personalized recommendations, so you can spend less time worrying and more time earning points. (We’d love it if the Travel Freely app made this whole post obsolete!)

What Counts as a “Venture Family” Card?

When we say Venture family, we mean these three personal cards:

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

Capital One treats these cards as related for application timing and welcome bonuses, which is where the rules come into play.

Rule #1. One Venture Card Every Six Months

Capital One has a hard-and-fast rule: you can only be approved for one new Venture family card every six months.

What this means in real life

If you’re approved for any Venture card, you’ll usually need to wait at least six months before applying for another Venture card.

Example: If you’re approved for the Venture Rewards card in January, the earliest you should apply for Venture X or VentureOne is July.

Applying sooner than that often leads to a denial, even for people with excellent credit. Capital One is especially cautious about recent applications and credit inquiries, so spacing things out matters.

Rule #2. Capital One’s 48-Month Welcome Bonus Rule

This is the rule that causes the most confusion.

Capital One now uses a 48-month rule to decide whether you’re eligible for a welcome bonus on a Venture family card. This rule applies even if you’re approved for the card.

One important detail: the 48-month clock starts when your bonus posts to your account, not when you open or close the card.

How the 48-Month Rule Works (Simple Explanation)

The easiest way to think about this is as a Venture family ladder. 🪜

You can usually move up to a higher-tier Venture card and still earn a bonus.

But moving down, or switching between certain Venture cards, may block you from earning another bonus for up to 48 months.

Here’s how it works for each card:

| If you apply for… | You won’t get the bonus if you earned… | Simple way to think about it |

|---|---|---|

| Venture X | A Venture X bonus in the past 48 months | Venture X only blocks itself |

| Venture Rewards | A Venture Rewards or Venture X bonus in the past 48 months | Venture or Venture X blocks Venture |

| VentureOne | Any Venture family bonus in the past 48 months | Any Venture bonus blocks VentureOne |

Example: You got a VentureOne bonus last year. You can’t get another VentureOne bonus, and you also can’t get a Venture Rewards bonus yet. But you can get a Venture X bonus.

Further Reading: Read Why Ventures Cards Are Great for Points and Miles Beginners

What This Means in Practice

Here’s the big picture takeaway:

Capital One doesn’t like issuing multiple Venture welcome bonuses close together, especially on lower-tier cards. Higher-tier bonuses often block lower-tier bonuses, and the exact rule depends on which card you’re applying for.

That’s why planning matters and why tracking this manually can get confusing fast. (Hint =) Get the Travel Freely app!)

How to Plan Venture Card Applications the Smart Way

To get the most value from the Capital One Venture family:

- Wait at least six months between Venture card approvals

- Keep track of which Venture bonuses you’ve already earned

- Factor in the 48-month bonus rule before applying

- Space out applications to limit recent credit inquiries

OR, if all of this feels overwhelming, the Travel Freely app does it for you. You get customized recommendations, never miss bonus eligibility, and can focus on earning points instead of spreadsheets.