Chase Ink Business Cash® Complete Guide

The Chase Ink Business Cash® is certainly one of our favorite cards. It has no annual fee, it offers awesome 5X category bonuses (and a couple of decent 2X bonuses), and even though it is advertised as a cash back card it actually earns valuable Chase Ultimate Rewards points. Surprisingly this no-fee card offers a few valuable perks as well, such as: auto rental coverage, 1 year extended warranty, and 120-day purchase protection.

Chase Ink Business Cash Application Tips

Should you apply?

Even though this is a business card, this is one of the first cards almost all point collectors should get. It offers a terrific combination of a great signup bonus, no annual fee, super-valuable points, and awesome 5X category bonuses. Maybe if you are eligible (see next section), you should get this card.

Are you eligible?

First of all, to get this card you must have a business, and you must be under 5/24:

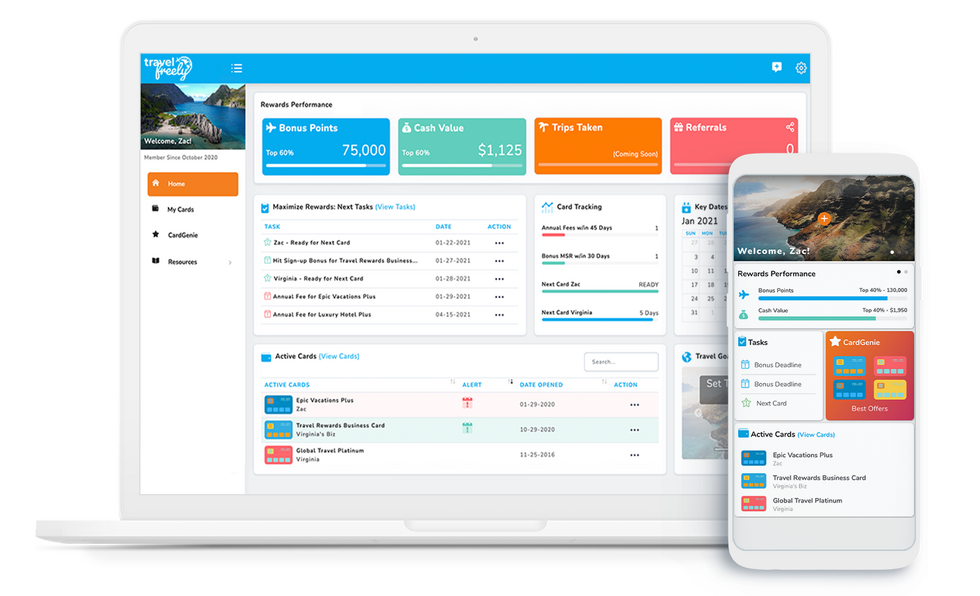

Applying for Business Credit CardsYes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it’s common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning a rental property, renting on Airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.Hence, when you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business’ address and phone, and your social security number as the business’ Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, a lot of people use business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. It is advised that you don’t use the card for personal expenses if you’re not comfortable doing so. Chase’s 5/24 Rule: Unfortunately, with most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: Check Your 5/24 Status INSTANTLY. The easiest option is to track all of your cards for free with Travel Freely. |

Chase Ink Business Cash: How to apply

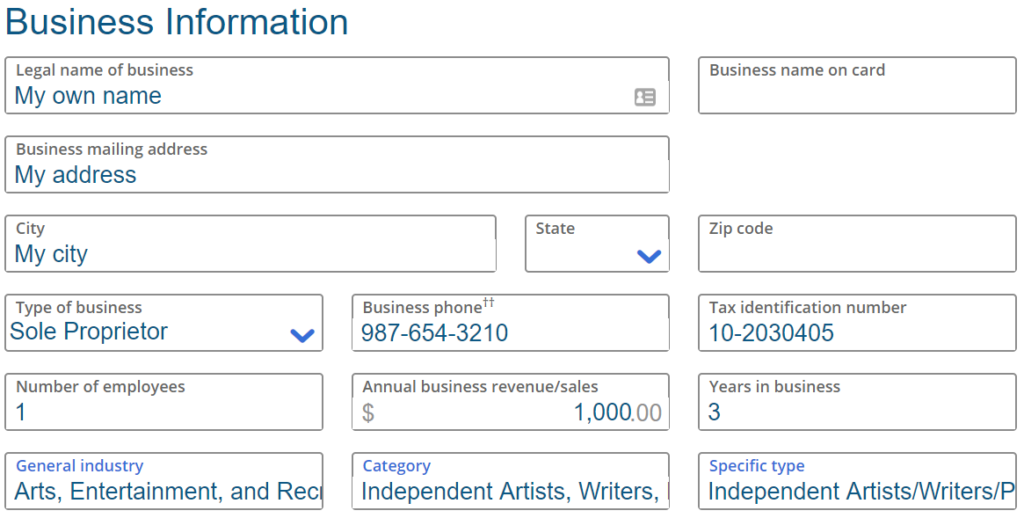

The first part of the application is about your business. So, if you already have a well-established business, then the answers should be straightforward. If you are just getting started with your business, below are examples of how to fill this out. These answers assume that you do not have any employees and you operate as a sole proprietorship (which is the most basic form of a business). Use your judgment to answer differently if the examples given don’t match your circumstances:

Business Information

- Legal Name of Business: If you don’t already have a business name, It is recommended that you use your own name as the business name.

- Business Name on Card: Again, this can be your own name if you don’t have a business name to use.

- Business Mailing Address: This can be your home address if you don’t have a separate business address.

- Type of business: Sole Proprietor

- Tax Identification Number: This can be your SSN, but I recommend creating an EIN for your business (you can get an EIN quickly and for free from the IRS here)

- Number of Employees: 0 (do not count yourself as employee)

- Annual Business Revenue: 0 (or project an amount based on expected revenue)

- Years in Business: (number of years you’ve been operating the business with or without revenue)

- General industry, Category, Specific type: Pick whichever categories are closest to your business. For example, an aspiring author, artist, or musician might choose: “Arts, Entertainment, and Recreation” and “Independent Artists, Writers, Performers.”

Personal Information

This part of the application is about you, personally:

- Your title as Authorizing Officer: “Owner”

- Total gross annual income: Include all of your income, not just business income. This can include household income.

- The rest should be self-explanatory

Keep records of your answers: In some cases Chase will ask to speak with you before approving your application. So in those cases, they are likely to ask some of the same questions (annual business revenue, number of years in business, total gross income, etc.). Ideally, you’ll answer the same as you did on the application. Check Application Status Furthermore, after submitting your application, you can check status by calling the automated status line: (888) 338-2586

Reconsideration

In the event that your application gets denied later on, It is recommended that you call for reconsideration (1-888-270-2127). It’s ultimately surprising how often denials can be changed to approvals just by asking.

Chase Ink Business Cash Perks

Auto Rental Coverage

Chase offers primary auto rental CDW (collision damage waiver) especially when renting for business purposes. Here’s the description directly from Chase:

Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the U.S. and abroad.

Purchase Protection

Extended Warranty: “Extends the time period of U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.”

Damage and Theft Protection: “Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.”

Chase Ink Business Cash Earn Points

Signup Bonus

At the present time, the signup bonus for this card is advertised as cash back, but the rewards are actually delivered as Ultimate Rewards points. Here’s the current signup offer:

Spending Categories

In reality, this is where the action is… the Ink Cash card offers 5X in combined purchases at office supply stores and on cell phone, cable, and internet on up to $25,000 in total purchases per account anniversary year.

Automated 5X

It is recommended that you set up autopay with your cell phone, cable, and internet provider to charge to your Ink Business Cash card. Meanwhile, this is a way you’ll automatically earn 5X on all of these bills. It is suspected that many households pay as much as $400 or more monthly on these services. With this in mind, $400/month in bills at 5X translates into 24,000 points per year.

2X on Gas and Dining

Don’t forget that the Ink Cash card also earns 2X at gas stations and restaurants (on the first $25,000 spent in combined purchases annually). Unless you have a card that offers better rewards in those places, the Ink Cash is a good choice.

Chase Ink Business Cash Redeem Points

Cash Back

Cardholders can redeem points for 1 cent each either as statement credits or as cash back. Cash back can be taken as a statement credit or via check or ACH transfer.

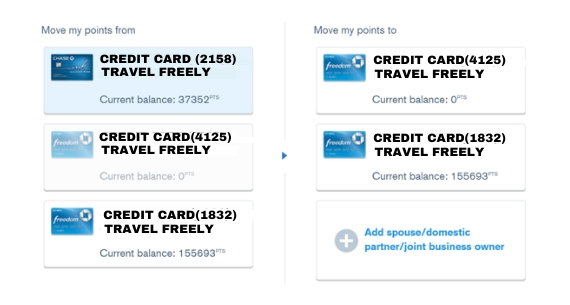

Travel

If you or another household member has a premium or ultra-premium Ultimate Rewards card, it is easy to get better than 1 cent per point value when redeeming points for travel. The trick is to move the points from your no-fee Ultimate Rewards card to the premium card before using points to buy travel. Chase allows you to freely move points to another card you own or to a card owned by a household member or business partner.

Details about booking travel through Chase

You can use the Chase Travel℠ portal to book airfare, hotels, cruises, activities, and car rentals — which is a great way to cut your travel expenses.

Airfare purchased through the Chase Travel portal still earns airline miles and elite qualifying miles. Hotels, on the other hand, booked this way do not earn hotel rewards. Worse, hotels booked through the portal often won’t offer you elite benefits even if you have status.

Transfer points

The best use of Ultimate Rewards points is to transfer points to airline and hotel partners in order to book high-value awards. Your best bet is usually to wait until you find a great flight or night award before transferring points. Points transfer at a ratio of 1:1 as shown in the list of transfer partners below. Keep in mind that while transfers are instantly posted to most loyalty programs and transfer partners, transfers to Singapore Krisflyer and Marriott Bonvoy are not instant.

| Partner | Transfer Ratio | Transfer Time |

|---|---|---|

| Aer Lingus AerClub | 1:1 | Almost Instant |

| Air France / KLM Flying Blue | 1:1 | Almost Instant |

| British Airways Executive Club | 1:1 | Almost Instant |

| Iberia Plus | 1:1 | Almost Instant |

| JetBlue TrueBlue™ | 1:1 | Almost Instant |

| Singapore KrisFlyer | 1:1 | 1-2 Days |

| Southwest Rapid Rewards | 1:1 | Almost Instant |

| United MileagePlus® | 1:1 | Almost Instant |

| Virgin Atlantic® Flying Club | 1:1 | Almost Instant |

| Partner | Transfer Ratio | Transfer Time |

|---|---|---|

| Hyatt World of Hyatt Points | 1:1 | Almost Instant |

| IHG® Rewards Club | 1:1 | 1 day |

| Marriott Rewards | 1:1 | 2 days |

| Ritz-Carlton Rewards | 1:1 | 2 days |

Move points to premium or ultra-premium card first

You cannot transfer points directly from a no-fee Chase Ultimate Rewards card to airline and hotel partners, but you can move points first to a premium card (Sapphire Preferred or Ink Business Preferred, for example) or ultra-premium card (Sapphire Reserve) and then transfer the points to airline or hotel partners. Chase Ultimate Rewards Guide will help you in managing your points. Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user on the account. Points can also be transferred to the loyalty account of a joint business owner, but they do need to be an authorized user on the associated business account.

Other ways to redeem points

Through the Ultimate Rewards portal, you can redeem points for cash back, gift cards, merchandise, or experiences. With this approach, you’ll usually get 1 cent per point value. One exception is that Chase occasionally offers gift cards at a discount so you may be able to get better than 1 cent per point value during a gift card sale.

You can also use points to pay some merchants directly (Amazon.com, for example, or via Chase Pay). Don’t do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone gets into your Amazon account, they might spend your Ultimate Rewards points – causing you a headache in getting your points reinstated).

Chase Ink Business Cash Manage Points

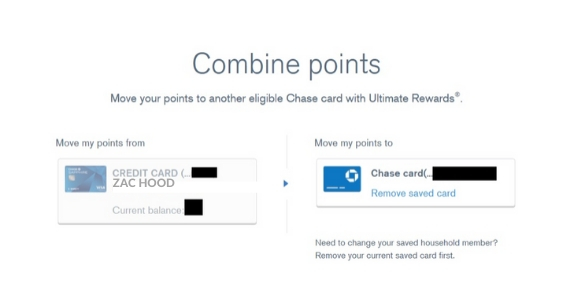

Combine Points Across Cards

If you are the primary account holder with multiple cards, you can freely combine Ultimate Rewards back and forth between your accounts. Your points can then be redeemed according to the card to which you move them. For example, if you have the no-fee Ink Business Cash card and the ultra-premium Sapphire Reserve card, you can earn 5X points per dollar on office supply purchases with the Ink Card and then move those points to your Sapphire Reserve account to redeem them for higher value where available. If you intend to cancel a Chase Ultimate Rewards card, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account. A product change should not affect your balance, but some people prefer moving points before a product change as well just to be safe.

Share Points Across Cardholders

Chase allows customers to transfer Ultimate Rewards points to any other account in that customer’s name or to one additional household member or joint business owner (for free).

Why this is valuable:

- You earn points with the card offering the best return on purchases and then use points with the card offering the best redemption rate.

- Only one member of your household needs to maintain a premium card for transferring to partners or booking travel (though note that the primary cardholder can only transfer points to partner loyalty programs in the name of the primary cardholder or authorized users).

How to Keep Points Alive

Thankfully, it is very easy to keep Chase Ultimate Rewards points alive: simply keep the points in an open Ultimate Rewards account and they will not expire. Note that if you close an Ultimate Rewards card, you will lose any points associated with that card. You should first combine points to move points away from the card you intend to close and to another card that will remain open as per the sharing section above before canceling.

Chase Ink Business Cash Summary Information

Note: This article was inspired by Frequent Miler – any content used with permission.