Beginner’s Guide to Freezing and Unfreezing Your Credit From All Three Credit Bureaus

Maintaining a good credit score is crucial in today’s world. From getting a loan for a new car to renting an apartment, your credit score plays a vital role in these decisions. However, the downside to having a good credit score is that it can make you a target for identity theft. That’s where freezing and unfreezing your credit comes in. In this blog post, we will guide you on how to freeze and unfreeze your credit from all three credit bureaus: Equifax, Experian, and TransUnion.

Freezing and unfreezing your credit

The process of managing a freeze – aka freezing or unfreezing – your credit is straightforward. All it takes is a request to the credit bureau, and your credit will be frozen until you unfreeze it. Here is how you can go about it:

How to do freeze and unfreeze:

Equifax: Visit the Equifax website freeze page. Click on the “Get Started on a Freeze” or “Manage a Freeze.” If this is the first time you are doing this, you’ll need to create a free account. Otherwise, follow the steps provided to complete the process.

Experian: Visit the Experian website to manage a freeze. If this is the first time you are doing this, you’ll need to create a free account. Then, click on the “Security Freeze” link located under the “Personal” tab. Follow the steps provided to complete the process.

TransUnion: Visit the TransUnion website freeze page, or go to the main TransUnion page and click on the “Credit Freeze” link located under the “Credit Help” tab. Follow the steps provided to complete the process. If this is the first time you are doing this, you’ll need to create a free account.

Unfreezing your credit is as simple as freezing it. There are claims that it can take a few days to unfreeze, I’ve found it to be instant. Note that it may also be an option to do a temporary freeze, where you can automatically freeze it back on a certain date. I tend to do this so I don’t forget. Because I may have an application that goes pending and need to keep it “unfrozen,” I tend to do the temporary freeze for about 30 days. If I get approved right away, then I can go in and freeze it immediately.

FAQs

What are the benefits of freezing your credit

A credit freeze helps protect your credit score and prevents identity theft. When you have a credit freeze in place, no one can open a new line of credit under your name without your consent. This helps safeguard your credit score and ensures that no one can take out loans or credit cards under your name.

How long does a credit freeze last?

A credit freeze lasts until you unfreeze it, and it can take a few business days to unfreeze. It’s essential to note that a credit freeze doesn’t affect your current credit score, and you can still apply for new credit while the freeze is in place.

Do I need to unfreeze for a business card application?

Yes. Almost all business card applications will do a credit inquiry on the person who is listed on the personal part of the application. So, a business card application won’t go through unless you have your credit unfrozen.

What credit bureau do different banks use?

This is really hard to predict. Most banks pull from various bureaus. I’ve heard that it can vary state by state. Capital One is known to pull from all three bureaus, so it may be helpful to unfreeze one of the three to avoid having all three pulled. But, YMMV if Capital One wants to see all three.

What happens if I forget to unfreeze and apply for a card?

You definitely won’t get approved. But, I’ve found the response to vary based on the bank.

One scenario is that some banks will let the application run and get back to you that you “appear to have your credit frozen and we were unable to check it. Please unfreeze/thaw your credit and contact us at this number.” This normally means everything is fine, but you need to follow the steps to move forward.

Another scenario is that a bank will just deny and reject you for the card without even telling you that they were unable to do a credit inquiry. This puts the burden on you to remember! In this instance, you want to call and explain. Then get their guidance on if they can use your original application, or if you should go ahead and apply again with unfrozen credit. Since they didn’t run a credit inquiry, your credit score wasn’t impacted on that original application.

A third scenario is where the application will not even go through. The bank will alert you that there’s a problem before you get down the road of applying. This would not count as an application because no credit inquiry was done. But, it can still be good to call the bank to double check.

Bottom Line:

Freezing and unfreezing your credit is getting to be more essential in today’s world. It helps protect your credit score and prevents identity theft from happening. The process of freezing and unfreezing your credit is straightforward, and all you need to do is follow the steps provided by the credit bureau. Remember, it’s free to freeze and to unfreeze, and these actions don’t affect your current credit score. Protect yourself today by freezing your credit from all three credit bureaus.

I’ve personally found the process to freeze and unfreeze so easy that I’ve started to do it as an added layer of security. It just takes a few minutes, and a good password tool can get you logging in quickly too.

However, the big issue is needing to remember that your credit is frozen when you are ready to apply for another card! I am guilty of this! If you don’t remember, there’s an added headache and follow up as mentioned above.

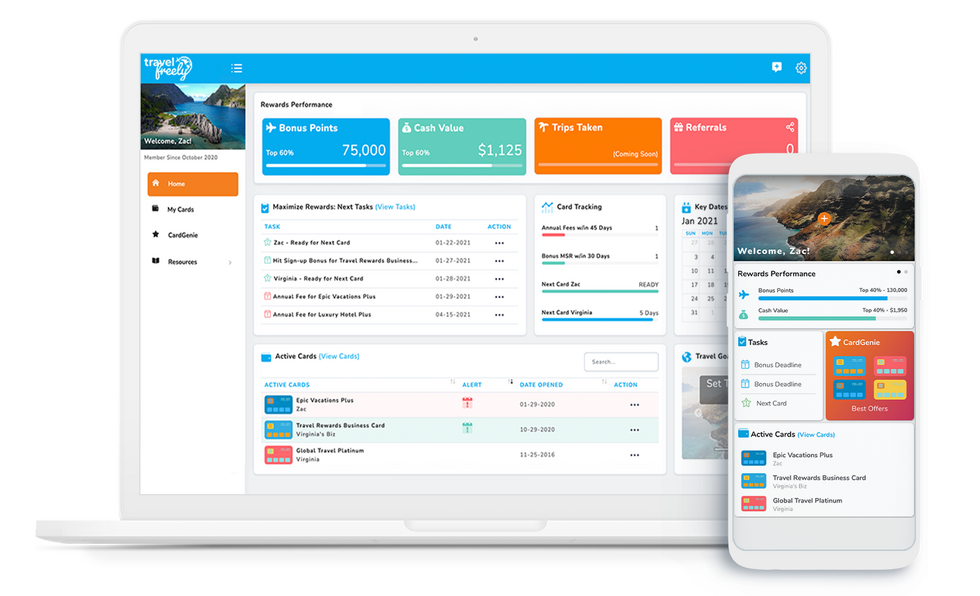

Shameless plug – if you do find you forgot to unfreeze your credit and the bank says to re-apply, please remember to use Travel Freely’s links again so we can earn a commission and support the site and app!