The Capital One Venture X Rewards Credit Card is so unique! The only way to give a fair analysis is to share all the details and do the math.

With a high annual fee, there isn’t really another card out there like this! And, for beginners, the fee might come as a shock. But, I want to encourage everyone to take a look at the math, and decide for yourself whether this is a card you may want now or in the future.

Disclaimer: If you decide to open up one of these cards, we’d love for you to sign up using one of our links on this page. We work hard to bring our app and content to you for free. By using the links on our site to apply for credit cards, you’ll help support the site in a big way.

What is the Current Welcome Offer?

Great "ultra-premium" card. Despite the big annual fee, the overall first year value is worth it for most people. This is due to the large signup bonus, extra benefits like Priority Pass, up to $300 annual travel credit and Global Entry/TSA PreCheck credit.

Spending Categories

- Earn 10x on hotels and rental cars booked through Capital One Travel

- Earn 5x on flights booked in the Capital One Travel portal

- Earn 2x everywhere else

Travel Perks

- $300 annual credit for bookings made via Capital One Travel

- Unlimited complimentary access for you and two guests to 1,400+ lounges, including Capital One Lounges and Partner Lounge Network

- $100 credit for Global Entry or TSA PreCheck

- Earn 10,000 bonus miles each account anniversary

Extra Benefits

- Add authorized users for no annual fee

- Complimentary Hertz President’s Circle status for primary cardholders and authorized users

- Because this is a Visa Infinite card, other benefits include primary auto rental insurance, trip cancellation/interruption reimbursement, travel accident insurance, lost luggage reimbursement, trip delay reimbursement, cell phone protection, and extended warranty protection

- Get rental car elite status with Avis, National, and Silvercar

Is the card worth the high annual fee?

Aside from all the extras and the value they bring, here’s the major math on what you receive:

$750 min. signup bonus value + $300 travel credit + $100 Global Entry / TSA PreCheck credit

–

$395 annual fee

=

$755 in first-year value

This value gets higher if you utilize lounge access.

Note to intermediate and advanced users

Capital One recently stepped up their game with transfer partners in a big way.

I know many of you will be excited about miles that can be transferred to partners that include: Air Canada, Avianca, British Airways, Cathay Pacific, Emirates, Etihad, Air France, Qantas, Singapore, and Turkish Airlines.

How does this travel rewards card stack up to the others?

Here are two other top personal cards right now:

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."

Why?

The Sapphire Preferred and Citi Premier are great overall cards with significantly lower annual fees.

However, I see all three as great options based on your spending and your situation.

One way this is a no-brainer:

Capital One “Miles” work differently. If you have any kind of big travel coming up in the next 6 months (or a vacation rental or cruise deposit due), this card will essentially give you $750 back. You use the card for the travel expense, then use miles to reimburse yourself for part or all of the purchase.

Here’s a video walkthrough of exactly how these “miles” work.

Things to keep in mind

1. You must be aware of the card application rules for Capital One. You will not be approved unless you are clear of these rules…

- To get this card, you must wait up to 6 months after applying for a Capital One card before you can be approved for another Capital One card.

- You are limited to 2 personal cards at a time. You will be denied if you already have 2 Capital One personal cards. This limit does not include co-branded cards.

2. This card requires more spending (but you have more time than usual).

One easy strategy would be to use this card to pay taxes if you have a big quarterly tax payment due, or even your annual tax return in April (since you have 6 months to his this bonus). However, do NOT get sucked into more spending than usual in order to hit this bonus.

3. Approval odds.

Capital One has been known to be unpredictable on approvals for their premium cards for people who have gotten quite a few cards in the past year. Even if you have excellent credit, it doesn’t guarantee approval. Anecdotally, many people with lower than excellent credit scores seem to get approved Capital One cards. The Venture X seems to buck this trend. It seems more predictable. The average person with good to excellent credit has been generally approved for the Venture X.

If you haven’t gotten many cards this year, then you should be in the best shape. This means that the beginner just getting started is in a good spot for this card.

Great "ultra-premium" card. Despite the big annual fee, the overall first year value is worth it for most people. This is due to the large signup bonus, extra benefits like Priority Pass, up to $300 annual travel credit and Global Entry/TSA PreCheck credit.

What would Zac do?

After giving it a bunch of thought, I decided that I will apply for this card. My wife will apply too!

Here are a few thoughts:

- If you are shaking in your boots about the annual fee, I would pass on this card. It’s not worth the stress for you. It’s also not worth getting if it will discourage you from getting other cards with annual fees.

- If you already have the Chase Sapphire Preferred and Citi Premier, I would take a very strong look at this card!

- If you stumbled onto Travel Freely and only want one card for the rest of your life, this is a good candidate because it’s easy to earn miles (2x on everything) and redeem. You can add authorized users at no cost to get them lounge access too.

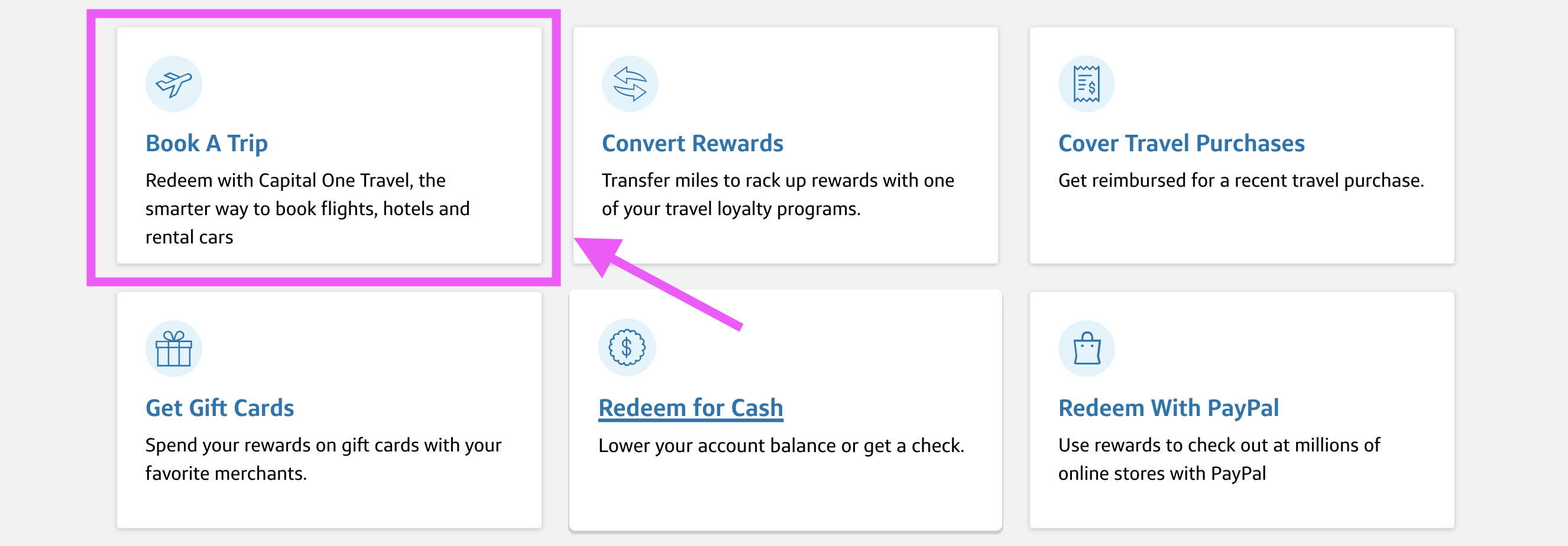

How to use the Capital One Travel Portal to Redeem Your Free Travel

With the $300 annual travel credit, Capital One Venture X card cardholders will probably find themselves booking travel via the Capital One Travel Portal. After all, you’ll want to make the most of your credit!

I was able to redeem my travel credit just one week after getting approved for the card. It’s pretty easy to redeem your $300 travel credit. Here’s how I did it:

First, I logged into my Capital One account and navigated to the Capital One Travel Portal.

Redeem your $300 of Free Travel in the Capital One Travel Portal

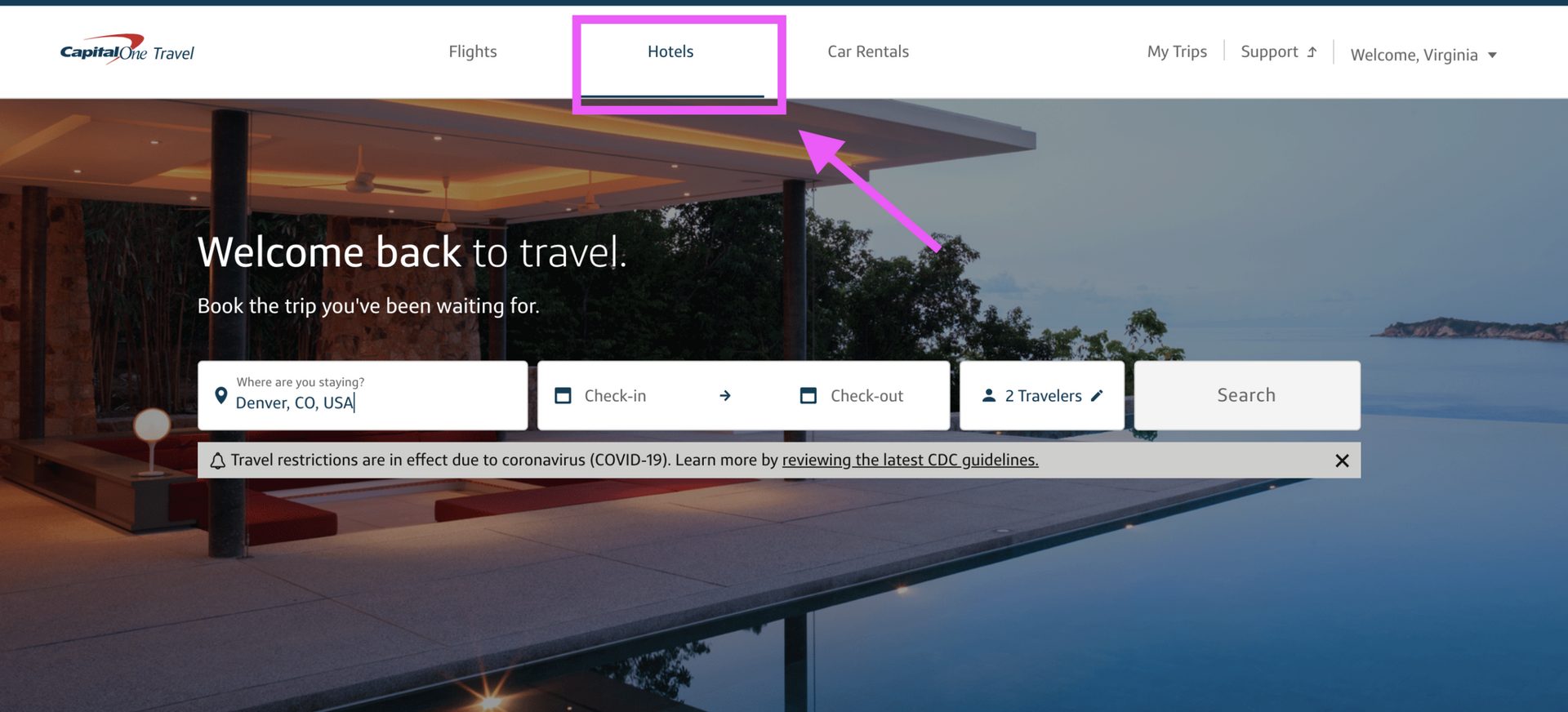

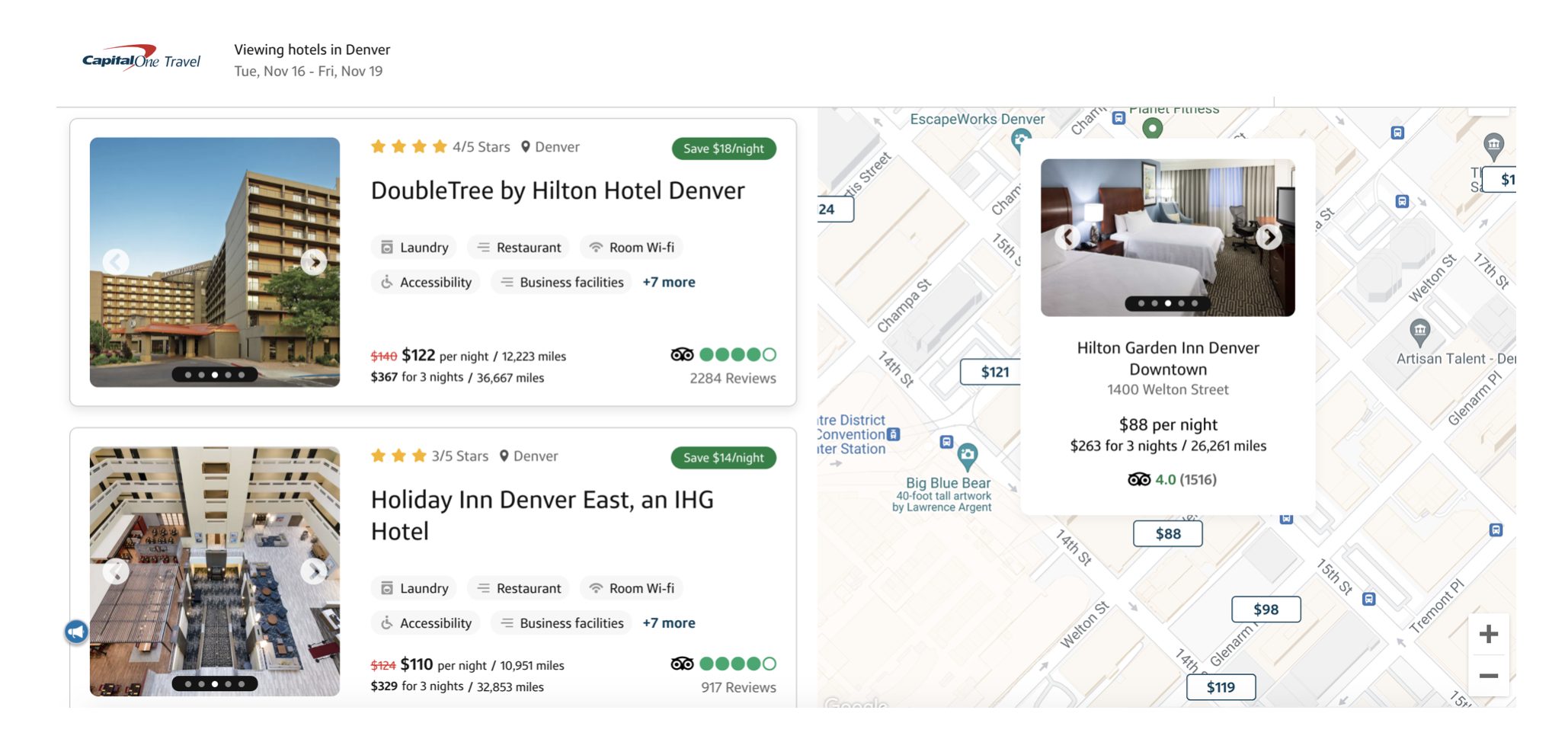

Then, because I was booking a hotel, I clicked on the “Hotels” tab to start my search.

I was happy to see that I had a lot of options for hotels. Once I found the hotel that I wanted, I continued with the booking.

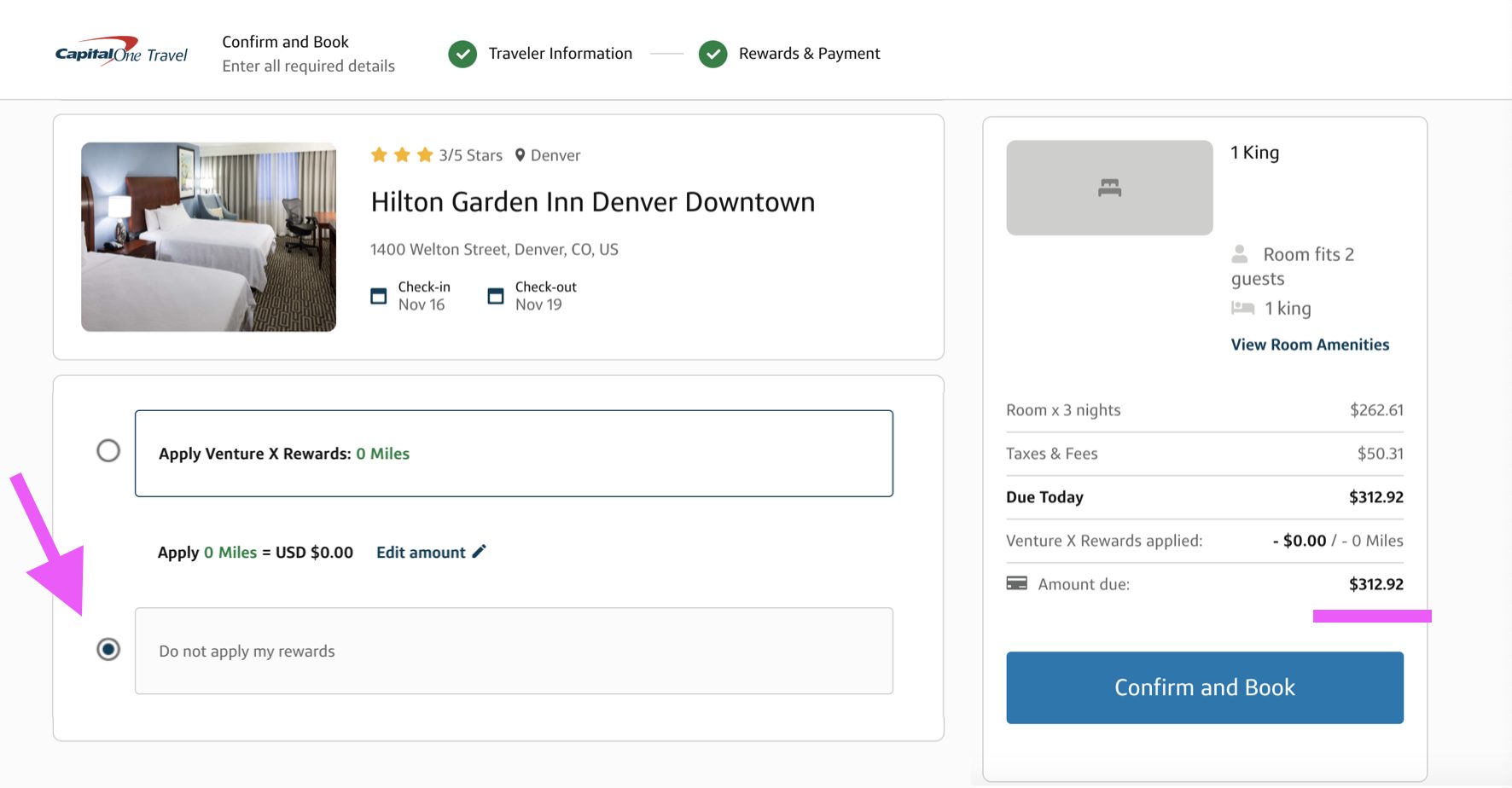

Because this is a brand new card, I didn’t have any points to use for this reservation. So, I used the card to book the hotel. Because the cost of the hotel was $312, I’ll use up my annual $300 travel credit in this one purchase.

I was able to use my $300 annual travel credit to book this hotel.

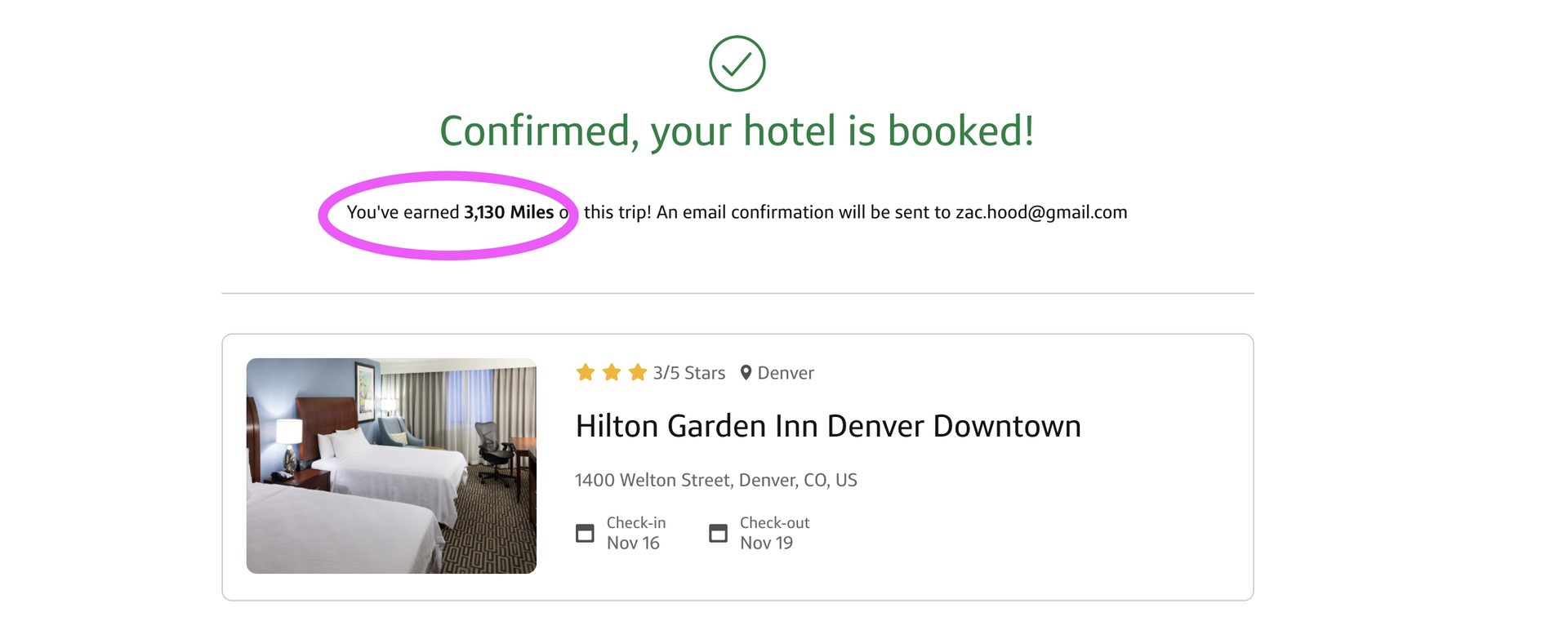

Another cool thing is that I earned 10x points on the purchase because this card earns 10x on purchases made in the Capital One Travel Portal. So, that came out to 3,130 points—an additional $30 I get to spend on future travel.

I earned additional points on this reservation, thanks to the awesome 10x earning structure on purchases in the Capital One Travel Portal.

Bottom Line

The math easily works out in our favor, despite the higher annual fee. It’s well over $1,100 in overall value. As I said above, my wife and I will definitely be getting this card at some point if we can get approved. Update, my wife did get instantly approved! =)

Great "ultra-premium" card. Despite the big annual fee, the overall first year value is worth it for most people. This is due to the large signup bonus, extra benefits like Priority Pass, up to $300 annual travel credit and Global Entry/TSA PreCheck credit.

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."