Citi ThankYou® Points Guide

American Airlines is now a transfer partner of Citi ThankYou® Points! For travelers that value American Airlines miles, that’s a big deal. It means more flexibility, more access, and more ways to book both affordable domestic flights and premium cabins that are normally tough to snag.

Citi ThankYou® Points, the rewards program from our partner, Citi, can be earned via credit card and bank account bonuses. Those points can then be transferred to various partners, used to pay for travel or merchandise, redeemed to pay bills, or converted to cash back. Citi ThankYou Points competes directly with other transferable points programs including Capital One® Miles, Chase Ultimate Rewards® and Amex Membership Rewards®.

Most people get these points from the Citi Strata Premier® Card, which is Citi’s own version of the well known Chase Sapphire Preferred® Card.

Like Chase Ultimate Rewards®, Citi ThankYou Points are a great option because they are a flexible point currency. With airline and hotel loyalty programs, your points are typically limited to redemptions within that specific brand. Flexible point currencies, on the other hand, offer far greater versatility, allowing you to use your points across multiple travel partners. That’s why I recommend prioritizing flexible point currencies over brand-specific loyalty programs.

One big advantage of the Citi ThankYou Points program is that you can transfer points to American Airlines AAdvantage® at a 1:1 rate when you hold premium cards like the Citi Strata Elite or Citi Strata Premier. Other ThankYou-earning cards transfer at lower ratios.

Why does this matter so much? American Airlines has the most extensive domestic network of any U.S. carrier. While Chase transfers to United and Amex transfers to Delta, only Citi gives you access to American — and that opens up significantly more redemption options, especially if you live near an American hub like Dallas, Charlotte, Phoenix, or Miami.

Below, you’ll find everything you need to know about ThankYou Points.

Earn Points

Credit Cards

The easiest and quickest way to earn ThankYou points is through Citi credit card signup bonuses, category bonuses, and retention offers (call about once per year to ask if any offers are loaded to your cards). Below are the currently available Citi cards that earn ThankYou rewards (and that Travel Freely recommends).

Personal

Business

Citi Business ThankYou Card (Only available in-branch)

Redeem Points

In general, ThankYou Rewards points are worth up to 1 cent each. There are two ways in which it is possible to get more value, though: redeem points for travel or transfer points to airline partners. More on that below…

Travel

In general, if you book travel through the Citi ThankYou portal, you’ll get only 1 cent per point value. Because of this, and depending on the card you use, it’s actually better to just book your travel with your credit card (instead of using points), as it’s easier to deal with the airline or hotel directly in case a problem occurs with your itinerary. Additionally, when booking directly, you’ll earn points on your hotel stay or flight.

Then, you can instead redeem your Citi points for cash back at 1 cent per point — the exact same value as you receive when booking travel through the portal with your points. Note as of 8/24/25, the cash back redemption value has decreased for the Citi Strata Premier and the Citi Prestige cards. The ratio for cash back on these cards is now 0.75 cents per point.

All other ThankYou points earning cards still offer the 1 cent per point redemption, so if you’d still prefer to book through the portal with your points, here are the steps to do so:

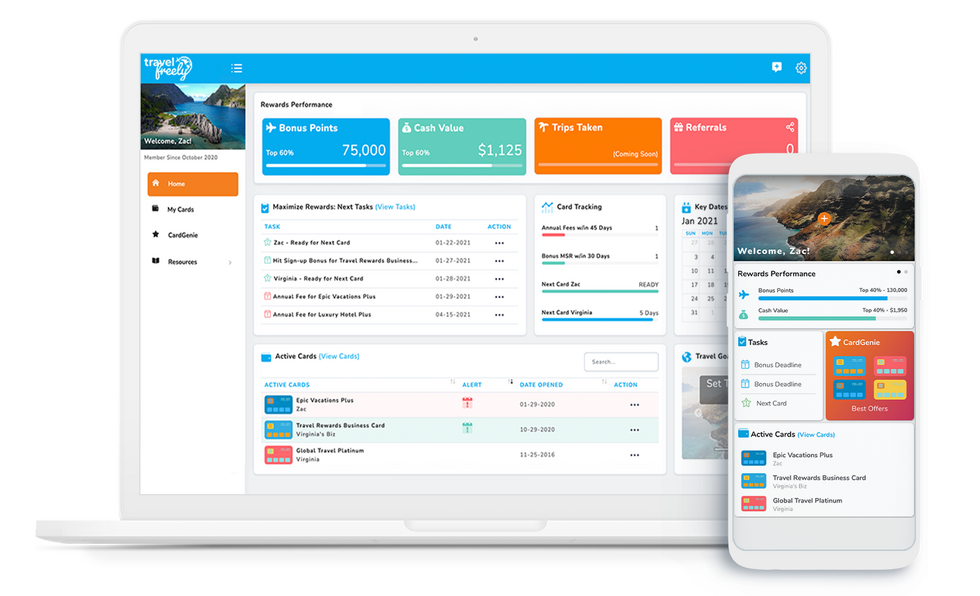

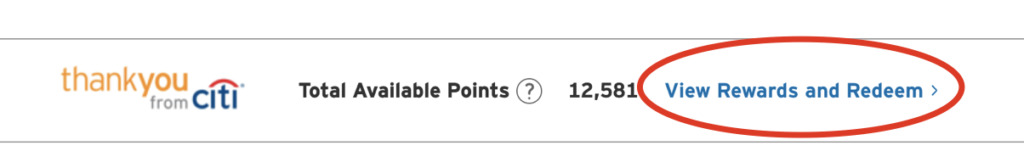

First, you’ll need to log into your ThankYou Points portal.

How to log into your ThankYou Points Portal

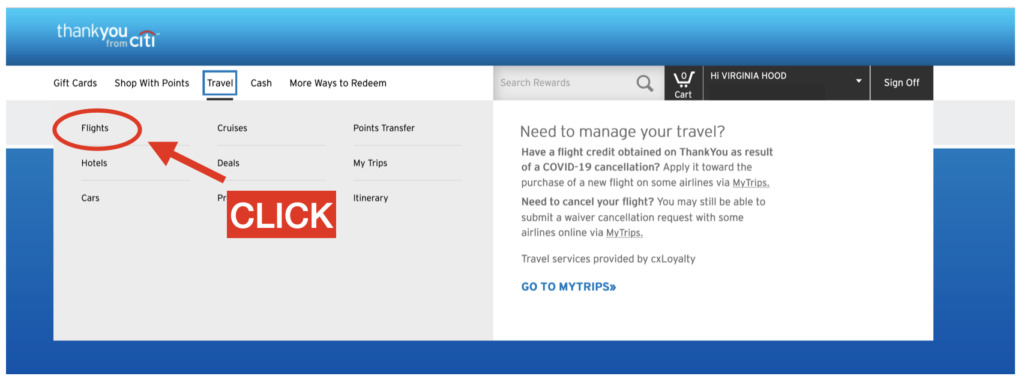

Once in the portal, click the “Travel” tab near the top of the screen. From there, you can book flights, hotels, car rentals, and even cruises.

Select the “Travel” tab to view the many booking options in the ThankYou Points portal

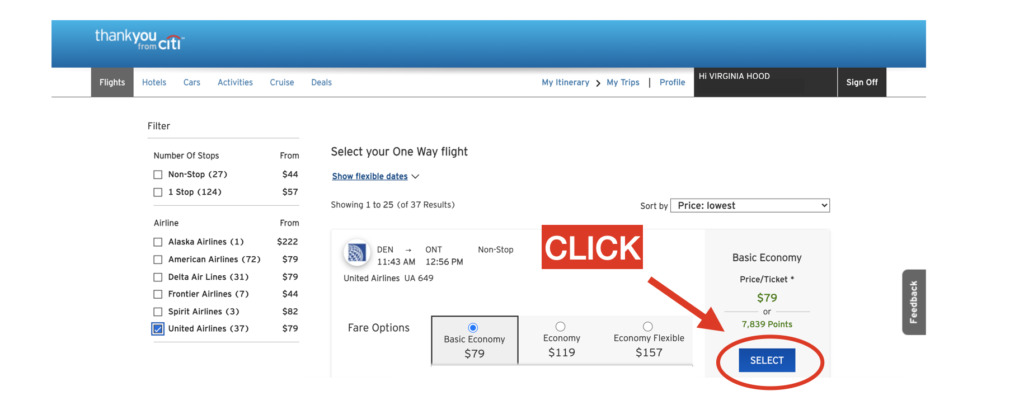

Here, you can easily search for your preferred booking. In the portal, you’ll earn 1 cent per each ThankYou point.

Once you’ve found your preferred booking, click “select” to checkout

Redeem points for a 4 night hotel stay: 25% point discount pre-tax (up to 1.33 cents per point value)

One exception to the 1 cent per point is the Citi Prestige Card’s 4th Night Free benefit. This option requires the Citi Prestige Card (no longer available). Book a 4 night hotel stay for the price of 3 nights (not counting taxes & fees, the 25% discount results in 1.33 cents per point value). If you would like to use points earned on other cards, either combine your cards together or share your points (move points) from the other card to your Citi Prestige.

Hotels booked through the ThankYou portal this way do not earn hotel rewards. Additionally, hotels booked through the portal often won’t offer you elite benefits even if you have status.

Transfer points

The best use of ThankYou points can be to transfer points to various partners in order to book high-value awards using premium Citi cards like Citi Prestige (no longer available), Citi Strata Premier, Citi Strata Elite Card and AT&T Access More (no longer available) cards. Your best bet is usually to wait until you find a great flight award before transferring points. One exception: Citi often offers 25% or 30% transfer bonuses to certain programs (Virgin Atlantic and Air France are two recent examples). If you’re confident that you’ll use the points for good value, it may make sense to transfer points when those bonuses are in effect.

And while all qualifying ThankYou points earning cards now transfer to all Citi hotel and airline transfer partners they typically do so at a rate that is inferior to the Citi Prestige, Citi Strata Premier, Citi Strata Elite and AT&T Access More cards.

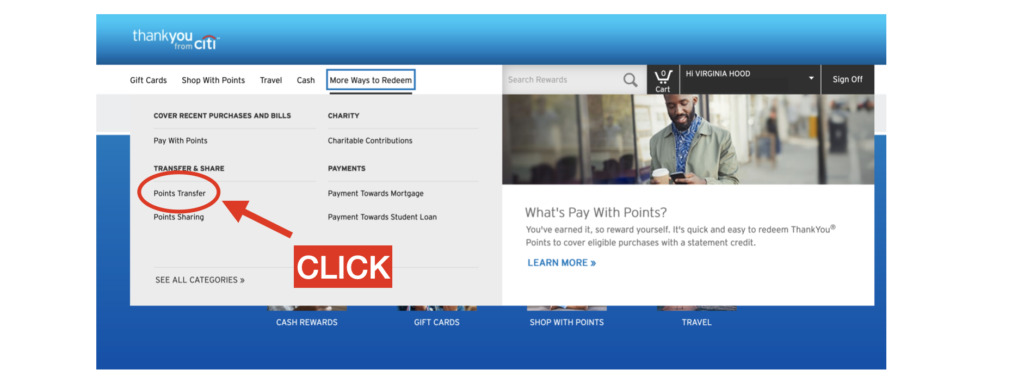

To transfer points, you’ll need to be logged into your ThankYou Portal. From here, navigate to the “More Ways to Redeem” tab.

Under “More Ways to Redeem,” select “Points Transfer”

Once on the “Points Transfer” page, you’ll find a list of all of Citi’s transfer partners from which you can choose. As mentioned above, it’s best practice to confirm award availability on the airline’s website before you proceed with transferring your points.

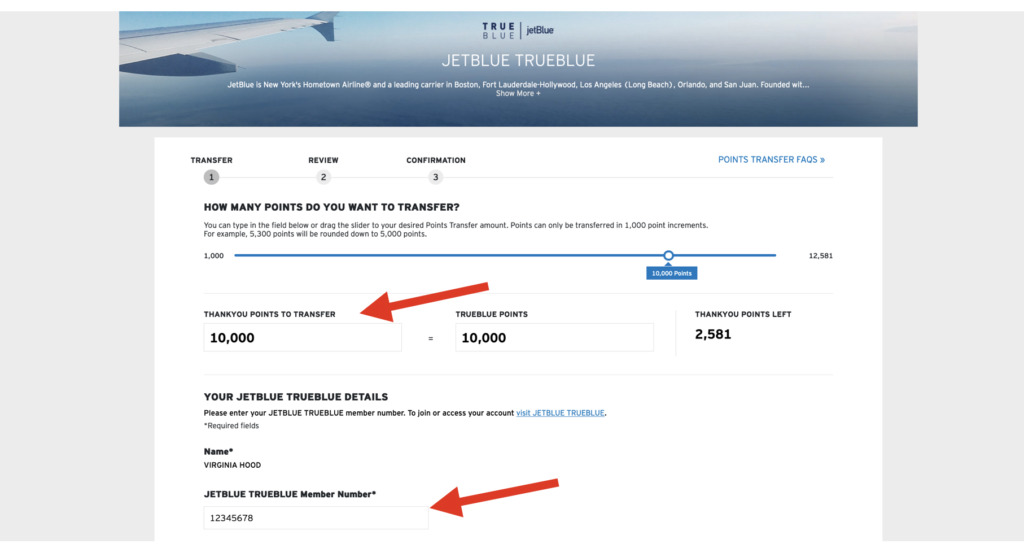

After selecting your preferred airline, you’ll be prompted to select the total number of points you’d like to transfer. Citi requires that you transfer a minimum of 1,000 ThankYou points, up to 550,000 ThankYou points.

Choose the number of points you’d like to transfer, and insert your airline rewards membership number.

Transfer Partners

| Partner | Transfer Ratio | Transfer Time | Best Uses | |

|---|---|---|---|---|

| Air France / KLM Flying Blue | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | Almost Instantly | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | |

| ALL - Accor Live Limitless | 1,000:500 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:350 for all others | Almost Instantly | ||

| American Airlines AAdvantage® | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠ cardmembers 1,000: 700 for all others | Almost Instantly | One of the very few transferable points programs with the ability to transfer to American Airlines (the other main option being Marriott). | |

| Avianca Lifemiles | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠ cardmembers, AT&T Access More Cardmembers; 1,000:700 for all others | Almost Instantly | Avianca LifeMiles can be great for Star Alliance awards. They offer reasonable award prices and no fuel surcharges on awards. They also offer shorthaul awards within the US (for flying United, for example) for as few as 7,500 miles one-way. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. | |

| Cathay Pacific | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | Almost Instantly | Cathay Pacific has a decent distance based award chart, but they no longer allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of first class by adding on a business class flight. | |

| Choice | 1,000:2,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:1,400 for all others | Instantly | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. | |

| Emirates Skywards | 1,000:800 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:560 for all others | Almost Instantly | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. | |

| Etihad Guest | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | 1 hour | Etihad has a very competitive award chart for American Airlines flights, among others. For example, they charge only 50,000 miles one-way for business class flights from North America to Europe. Partner awards must be booked over the phone. | |

| EVA Air | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | Almost Instantly | If you want to fly one of the best business class products in the sky, the best way to snag EVA flights is with their own miles since they release more award space to their own members. One-way business class flights from the US to Taipei cost 75K to 80K miles. Fuel surcharges are very low on these routes. | |

| i Prefer Hotels | 1,000:4,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:2,800 for all others | Almost Instantly | ||

| JetBlue | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | Almost Instantly | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. | |

| Leaders Club | 1,000:250 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:175 for all others | Almost Instantly | ||

| Qantas Frequent Flyer | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | 1 day | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. Compare award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) | |

| Qatar Airways Privilege Club | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | Almost Instantly | ||

| Singapore Airlines KrisFlyer | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | 1 day | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). | |

| Thai Royal Orchid Plus | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | Almost Instantly | ||

| Turkish Airlines Miles & Smiles | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | 1 day | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. | |

| Virgin Atlantic Flying Club | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | Almost Instantly | Virgin Atlantic offers a few great sweet spot awards including ANA first class between the US and Japan for as low as 55K points one-way; and US to Europe on Delta One business class for 50K points one-way. | |

| Wyndham Rewards | 1,000:1,000 for Prestige®, Citi Strata Premier®, Citi Strata Elite℠, AT&T Access More Cardmembers; 1,000:700 for all others | Almost Instantly | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. | |

Cash back

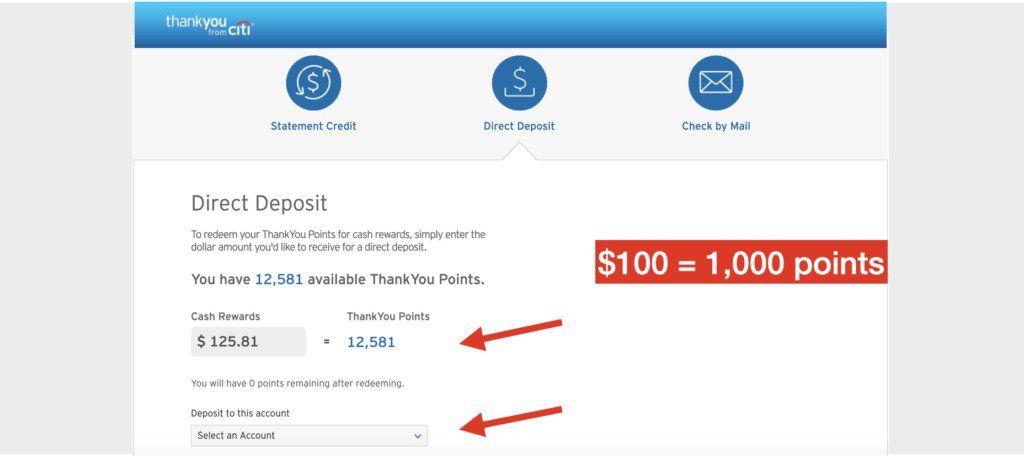

Citi ThankYou cardmembers can redeem points for 1 cent each as a statement credit. As of 8/24/25, the cash back rate for Citi Strata Premier and Citi Prestige cardholders dropped to 0.75 cents per point. All other ThankYou cards remain at 1:1 cash back ratio. The example below reflects those cards with 1:1 cash back ratio.

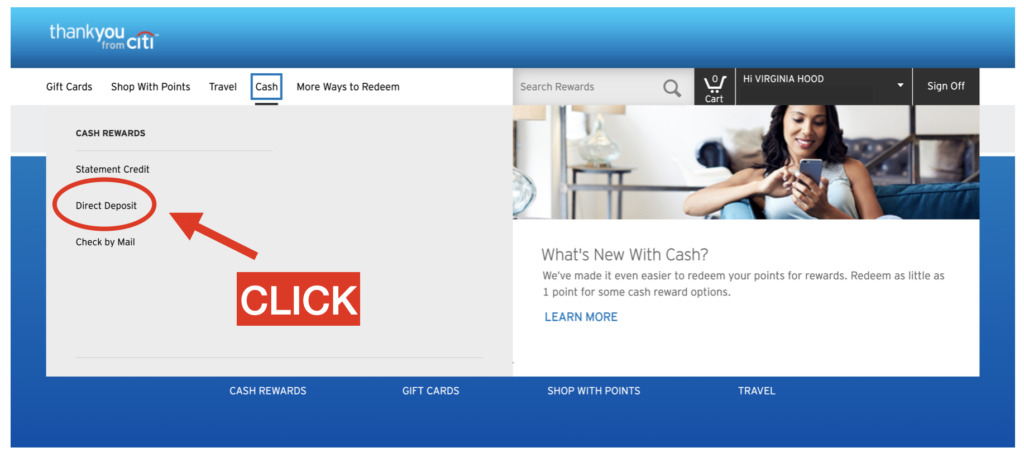

Under the “Cash” tab, select which form of credit you’d like.

Under the “Cash” tab, select “Statement Credit” or “Direct Deposit”

From there, you’ll insert your bank information and confirm the total number of points that you’d like to redeem in the form of cash back.

Confirm the number of points you would like to redeem

Other ways to redeem points

Through the ThankYou Points rewards portal you can redeem points for gift cards, merchandise, charity, bill payments, and more. At most, with this approach you’ll get 1 cent per point value. One exception is that Citi occasionally offers gift cards at a discount so you may be able to get better than 1 cent per point value during a gift card sale.

You can also use points to pay some merchants directly (Amazon.com, for example). Don’t do this. These options offer very poor value.

Manage Points

Combine Points Across Cards

If you are the primary account holder with multiple cards, you can combine ThankYou Rewards accounts. When your points are combined, they can then automatically be redeemed at the same value as your best card.

There are disadvantages to combining points:

- You lose the ability to pick and choose which points are used when you redeem awards.

- You lose visibility into how many points remain with each card.

The above disadvantages become important when you want to cancel a card: when you cancel a card, all points earned from that account are lost after 60 days. I recommend downgrading to a no-fee ThankYou card rather than cancelling outright. That way your points are safe.

Share Points Across Cardholders

Citi very generously allows people to transfer ThankYou points to anyone else, for free. There are two “catches” to this:

- Shared points expire after 90 days. Make sure you have a specific near-term use in mind before transferring points.

- 100K limit: Each member may share up to 100,000 points per calendar year. Each member may receive up to 100,000 points per calendar year.

Why this is valuable:

- A friend or family member with a Citi Strata Premier or Elite card can transfer points to a partner program at the highest transfer rate and book travel for you.

- If a friend has airline elite status with one of Citi’s transfer partners with which you want to book an award, you may be better off transferring points to your friend who can then transfer the points to the airline partner and book the award for you (to get free award changes, for example).

How to Keep Points Alive

There are several situations in which you may have Citi ThankYou Points that will expire:

- Points earned by a credit card account expire 60 days after cancelling that account.

- Points transferred to your account expire after 90 days.

- Points earned from some older credit cards expire in a set amount of time after points were earned (e.g. 3 or 5 years after December 31 of the year in which the points were earned).

- Points earned from some credit cards expire if your credit card account has no purchase activity in 18 months.

- Points earned from Citi banking products expire 3 years after December 31 of the year in which the points were earned.

Credit card points: how to keep points alive

With most credit card points (except with some older credit cards which are no longer available), points remain alive until you cancel the card from which they were earned. Once you cancel the card, points expire after 60 days.

Combining accounts does not solve the problem. When you combine multiple ThankYou accounts, it’s natural to assume that as long as you keep any ThankYou Rewards credit card open, your points will be safe. That’s simply not the case. Citi keeps track of where each ThankYou point came from. If you cancel a card, the points earned on that card expire after 60 days. Period.

The best way to preserve your ThankYou points is to keep your credit card account alive.

Downgrading is another option. An easy way to keep your points alive and to avoid an annual fee is to simply downgrade to a no-fee card.

Important info regarding points expiration: Citi product changes result in a weird transition period quirk. Soon after product changing from one ThankYou card to another, you can log into your account and you’ll see that your points will expire within 60 days. Don’t panic. Your points won’t really expire. Wait a few more weeks and you’ll see that the points no longer have an expiration date.

The downside to downgrading to a no-fee card, of course, is that this makes your points far less valuable as they transfer to partner programs at a lesser ratio.

Bank product points: how to keep points alive

Points earned from banking products (such as checking accounts) expire 3 years after December 31 of the year in which the points were earned. Fortunately, when redeeming points combined across multiple accounts, Citi automatically uses first whichever points have the most recent expiration date. So, in general, your banking product points (which eventually expire) will be used first if you have combined accounts.

More information

Citi’s official ThankYou Rewards FAQ can be found here.

(Some of this content originally appeared on The Frequent Miler and has been posted with permission.)

Related Articles: