The Capital One Venture X Business Credit Card is currently available to the public. There are major pros and cons here. The only way to give a fair analysis is to share all the details and do the math.

Capital One is certainly carving out its own unique path with a high spending threshold to secure the sign-up bonus! This spending requirement is overwhelming, but let’s put on our thinking caps, crunch those numbers, and work out whether this card could be a valuable addition to your wallet now or perhaps in the future.

Important 5/24 Note: Will this count towards 5/24? Unlike other business cards, every Capital One business card (except the Spark Cash Plus) has counted towards 5/24. However, we’ve seen 2 reports of this card NOT counting towards 5/24. Still monitoring this, but we don’t think it will count towards 5/24.

Disclaimer: If you decide to open up one of these cards, we’d love for you to sign up using one of our links on this page. We work hard to bring our app and content to you for free. By using the links on our site to apply for credit cards, you’ll help support the site in a big way.

What is the Current Welcome Offer?

A great offer but significant spending required. Definitely not for everyone. Very similar benefits to the consumer version (Capital One Venture X Rewards Credit Card), including the annual $300 travel credit that helps to offset the annual fee. Unlike other Capital One business cards, this card is not known to count towards 5/24.

Spending Categories

- Earn 10x on hotels and rental cars booked through Capital One Travel

- Earn 5x on flights booked in the Capital One Travel portal

- Earn unlimited 2x everywhere else

Travel Perks

- $300 annual credit for bookings made via Capital One Travel

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and Partner Lounge Network

- $100 credit for Global Entry or TSA PreCheck

- Earn 10,000 bonus miles on each account anniversary

- $50-$100 experience credit at the Premier & Lifestyle Collections (depending on the property)

Extra Benefits

- Add employee cards and virtual cards for free, set customized limits, track spending, and earn rewards from their purchases

- Other benefits include trip cancellation/interruption reimbursement, travel accident insurance, lost luggage reimbursement, trip delay reimbursement, cell phone protection, and extended warranty protection

- No preset spending limit

Is the card worth the high minimum spend?

After meeting that welcome bonus, you ‘ll earn a total of 30,000 miles plus an additional 60,000 bonus miles for reaching the minimum spend. At a redemption value of 1.6 cents per point, you are looking at $3,360. Aside from all the extras and the value the card brings, here’s the math on what you receive:

Venture X Business Welcome Offer: $3,360 welcome bonus value and minimum spend + $300 travel credit + $100 Global Entry / TSA PreCheck credit – $395 annual fee

=

$3,365 in first-year value

This value gets higher if you utilize lounge access.

How does this travel rewards card stack up to the others?

Here are three other top business cards right now:

Great signup bonus for a business card with no annual fee, now with an extended timeline for hitting the spend requirement. Great for carrying a balance. 5x earning categories, and if paired with a premier Chase credit card (one that carries an annual fee), your points are worth even more.

Great offer for a no annual fee card! A no-brainer, great business card. Your choice to receive 1.5% cash back or 1.5x points.

Three cards better than one?

Consider this — what welcome bonuses could you get if you got a different business card or two? If you signed up for the Ink Business Preferred® Credit Card, the Ink Business Cash® Credit Card, and Ink Business Cash® Credit Card, you would walk away with 250,000 bonus points and only $95 in annual fees for $20,000 total spending. Additionally, with the welcome bonus offering 250,000 miles after $20,000 total spend for all 3 cards, if you meet the full minimum spend requirement, you’ll earn a total of 270,000 miles once ($20,000 spend at 1 point per dollar = 20,000 points, plus the 250,000 miles total earned from the 3 offers). Plus, you would be spreading out these applications at your own pace to cover the required spending more easily.

Since we value Chase points at 1.8 cents each, this puts a conservative value of $4,860 for these three welcome bonuses in total. So for the three Ink welcome bonuses (with just $20,000 of spend), here’s the math:

Bonus Value of All 3 Inks: $4,860 signup bonus value and minimum spend – $95 annual fee

=

$4,765 in first-year value

That puts me $1,400 ahead of the first-year value of the Venture X Business, while also spending $10,000 less with the three Chase Ink cards. If you still want the perks and benefits of the Venture X Business, then simply consider the Capital One Venture X Rewards Credit Card personal card.

However, I see all four as great options based on your spending and your situation.

One way this is a no-brainer:

A number of business owners only want one or two cards to put all their spending on. And many have random big monthly expenses that would otherwise earn 1 – 1.5x with other cards. The Venture X Business has a chance to be more attractive to medium to larger business owners, especially if it’s more about big spending than using multiple cards. For example, my brother’s business has a lot of expenses each month, and he could probably hit these bonus requirements. In addition, he does not like to juggle cards for his business. So, this card could be a good short-term and long-term option for him.

Capital One “Miles” also work differently. If you have any kind of big travel coming up in the next 6 months (or a vacation rental or cruise deposit due), this card can be used similar to cash back. You use the card for the travel expenses, then use miles to reimburse yourself for part or all of the purchase.

Here’s a video walkthrough of exactly how these “miles” work.

Things to keep in mind

1. You must be aware of the card application rules for Capital One. You will not be approved unless you are clear of these rules…

To get this card, you must wait up to 6 months after applying for a Capital One card before you can be approved for another Capital One card. This applies to personal and business cards.

2. This card requires more spending (a lot more).

You must spend $30,000 within the first 3 months of being approved to receive the 150,000 bonus — averaging $10,000 per month in spend to receive the full bonus offer. That’s a tall order for a lot of small businesses. One strategy would be to use this card to pay taxes if you have a big quarterly tax payment due or even your annual tax return in April (depending on the timing of your application). However, do NOT get sucked into more spending than usual in order to hit this bonus.

3. Approval odds.

Capital One has been known to be unpredictable on approvals for their premium cards for people who have gotten quite a few cards in the past year. Previously, the only way to apply for the Venture X Business Card was through a Capital One relationship manager. Now that the card is publicly available, we’ll have to see how their approval process shakes out. Even if you have excellent credit, it doesn’t guarantee approval, and with Capital One it is notoriously difficult to predict approval odds. Additionally, despite being business cards, Capital One business cards (like the Spark Miles for Business) are known to count towards 5/24.

4. No payment terms

This is a pay-in-full card, so your balance is due in full every month, but you also have no pre-set spending limit.

What would Zac do?

After giving it some thought, I have decided I will not apply for this card right now. While I could forgo the second tier bonus, spending $30,000 still within just a three month time period is still a lot. The only chance I would apply would be if I have a major expense or tax bill that would allow me to meet the minimum spend requirement. Plus, I am going to wait to see if the card counts towards 5/24.

Here are a few thoughts:

- If you have high monthly spend on your business, then this card could be a great fit for you.

- If you are shaking in your boots about the minimum spend, I would pass on this card. It’s not worth the stress for you. It’s also not worth getting if it will discourage you from getting other cards.

- If you can’t hit the spending requirement but you really like the perks and benefits and 2x earning, I would strongly suggest looking at the Capital One Venture X Rewards Credit Card.

- If you get overwhelmed by travel rewards and only want one business card for the rest of your life, this is a good candidate because it’s easy to earn miles (2x on everything) and redeem. You can add authorized users at no cost and get points for their spend.

How to use the Capital One Travel Portal to Redeem Your Free Travel

With the $300 annual travel credit, Capital One Venture X Business card cardholders will probably find themselves booking travel via the Capital One Travel Portal. After all, you’ll want to make the most of your credit!

It’s pretty easy to redeem your $300 travel credit. Here’s how to do it:

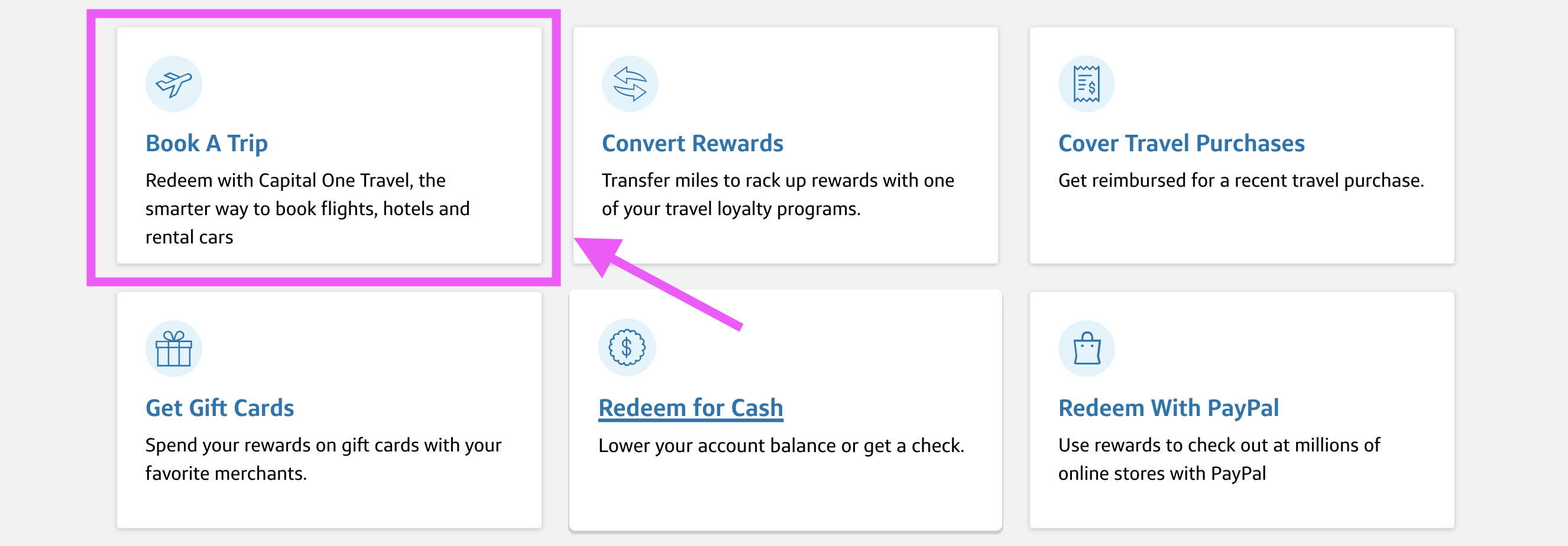

First, I logged into my Capital One account and navigated to the Capital One Travel Portal.

Redeem your $300 of Free Travel in the Capital One Travel Portal

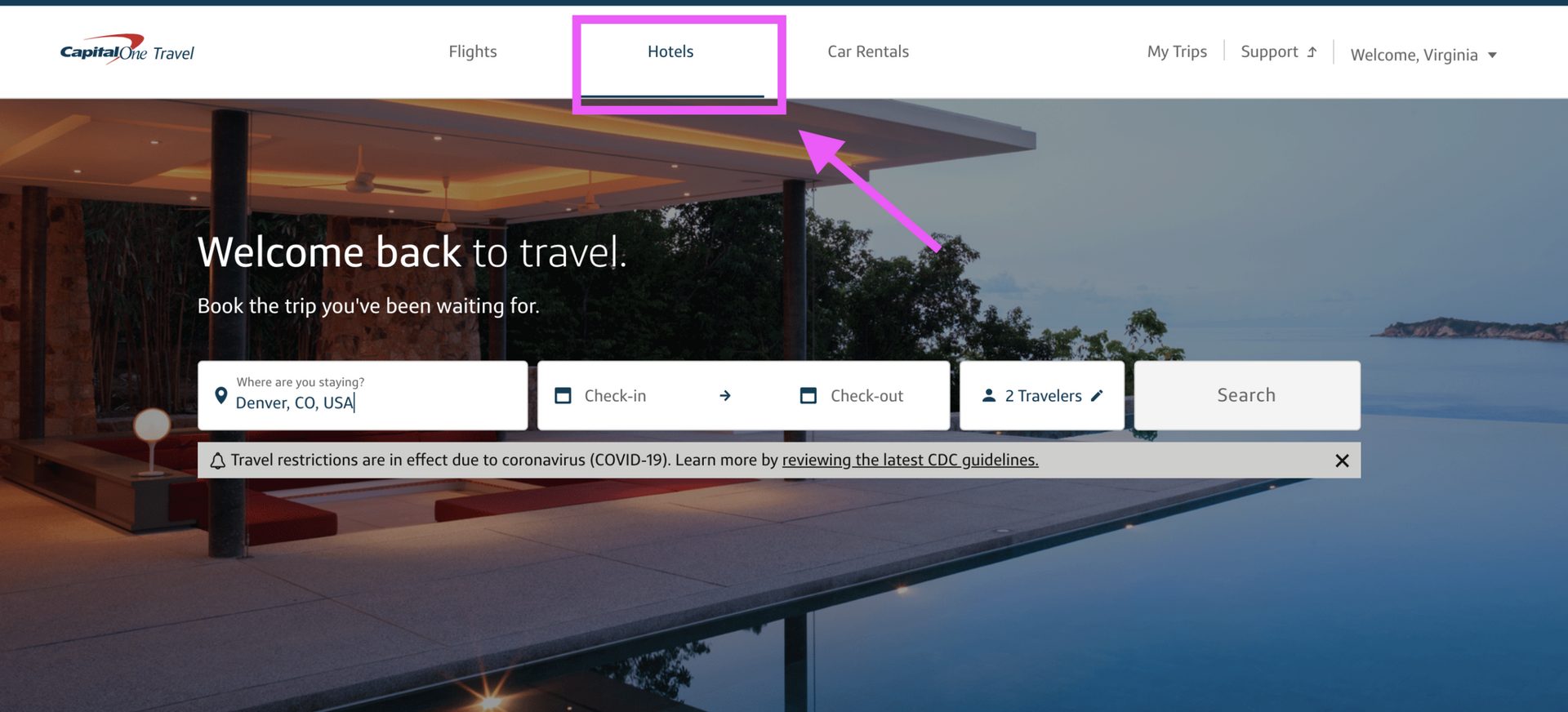

Then, because I was booking a hotel, I clicked on the “Hotels” tab to start my search.

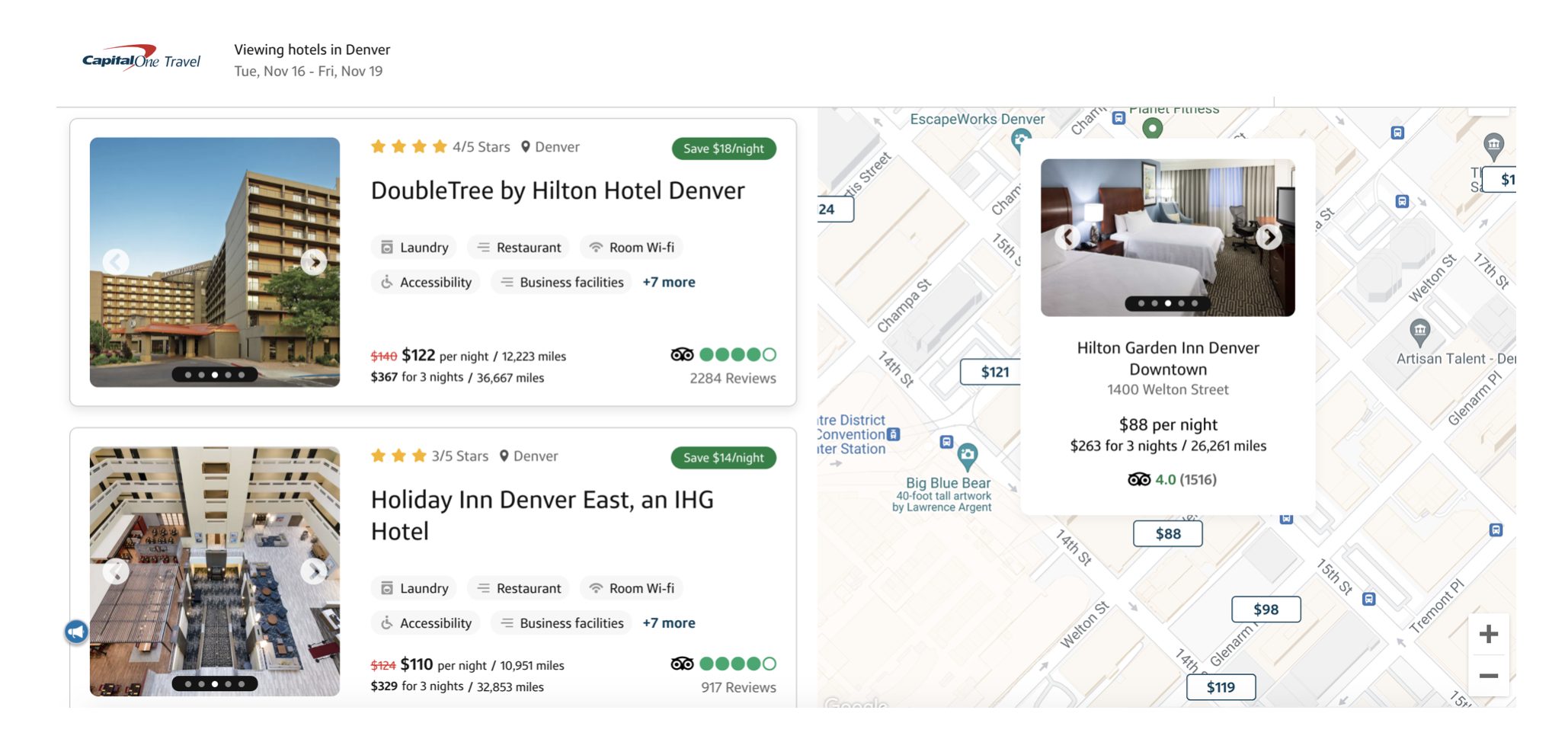

I was happy to see I had a lot of options for hotels. Once I found the hotel I wanted, I continued with the booking.

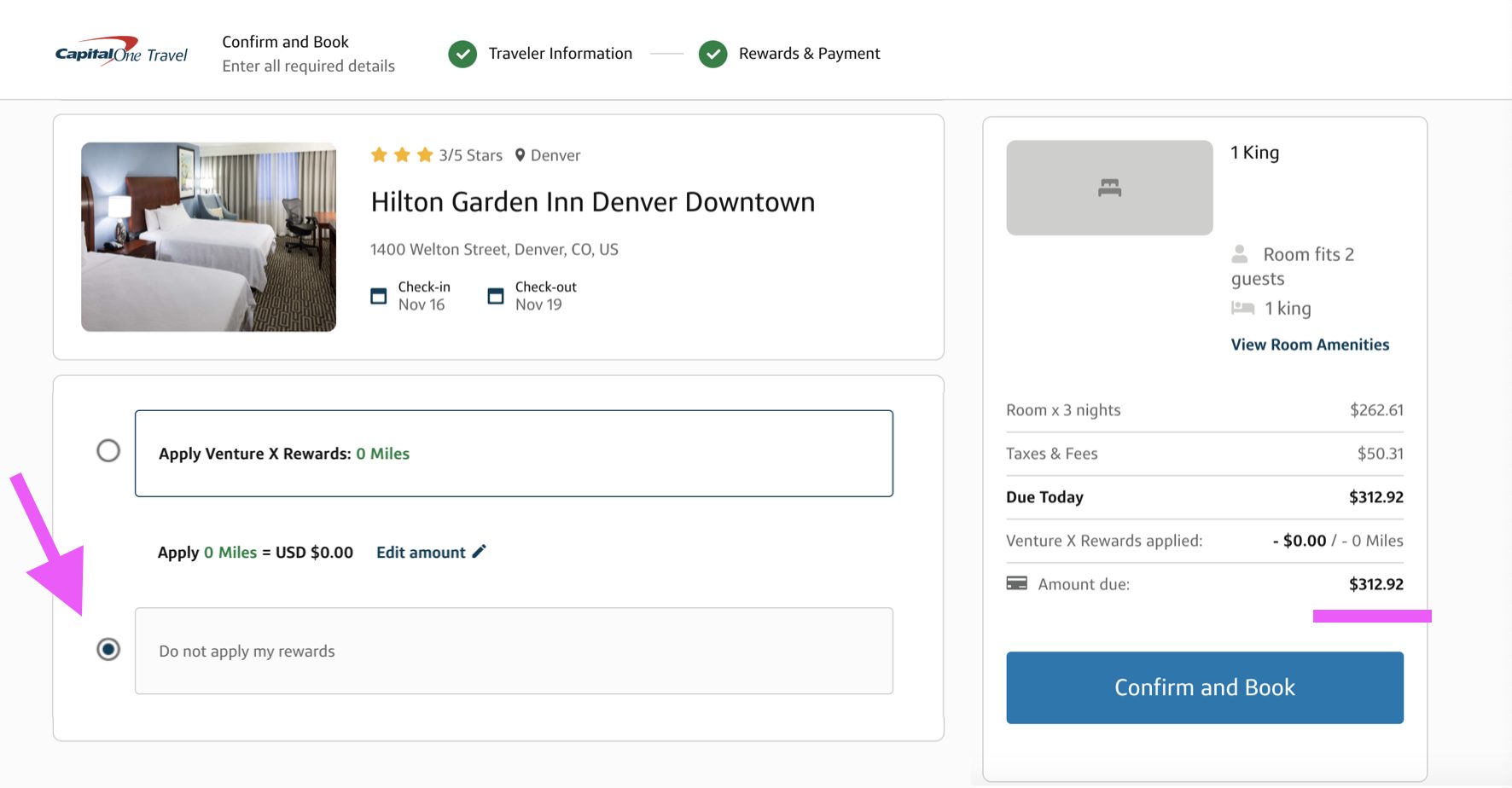

Because this is a brand new card, I didn’t have any points to use for this reservation. So, I used the card to book the hotel. Because the cost of the hotel was $312, I’ll use up my annual $300 travel credit for this one purchase.

I was able to use my $300 annual travel credit to book this hotel.

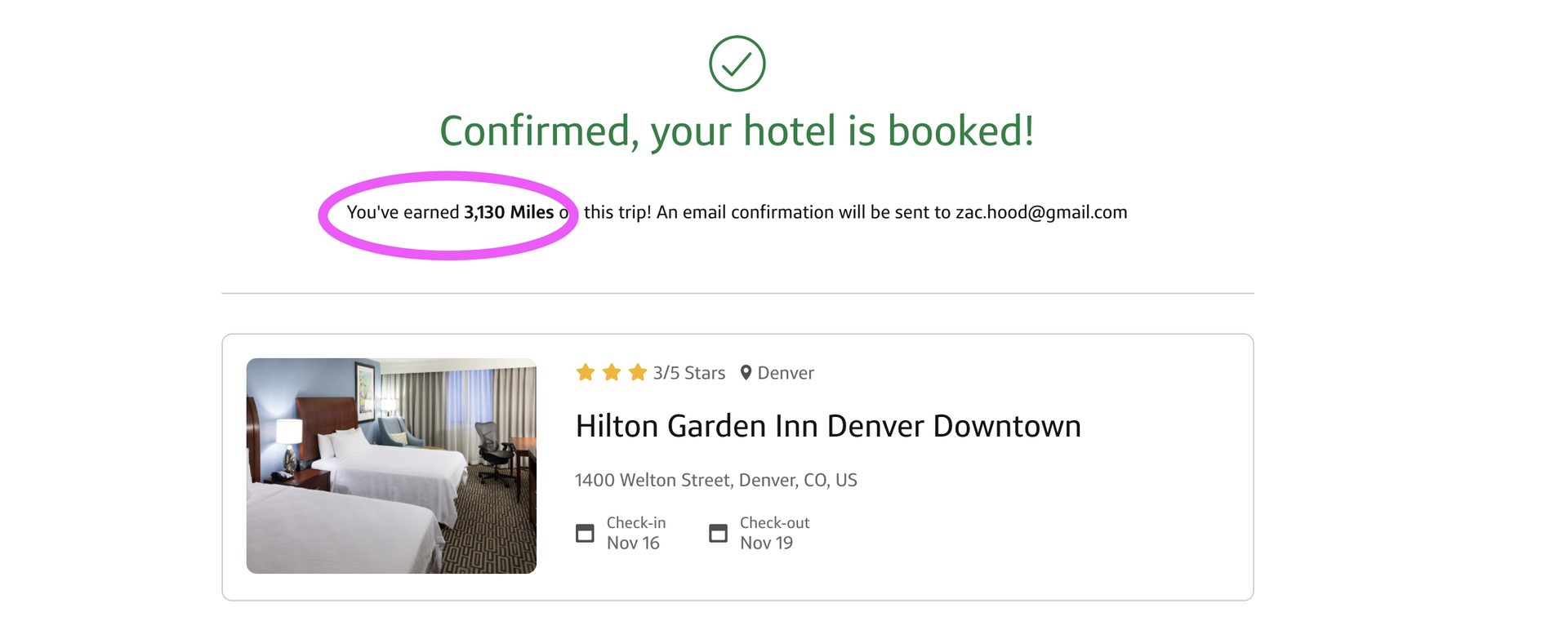

Another cool thing is that I earned 10x points on the purchase because this card earns 10x on purchases made in the Capital One Travel Portal. So, that came out to 3,130 points—an additional $30 I get to spend on future travel.

I earned additional points on this reservation, thanks to the awesome 10x earning structure on purchases in the Capital One Travel Portal.

Bottom Line

For me, this new card is not appealing because of the huge spending requirements. It shows me how incredible the other big business card offers are right now. But if the spending is fine and the math works out in your favor, it can be a huge value in your first year.

A great offer but significant spending required. Definitely not for everyone. Very similar benefits to the consumer version (Capital One Venture X Rewards Credit Card), including the annual $300 travel credit that helps to offset the annual fee. Unlike other Capital One business cards, this card is not known to count towards 5/24.

Great signup bonus for a business card with no annual fee, now with an extended timeline for hitting the spend requirement. Great for carrying a balance. 5x earning categories, and if paired with a premier Chase credit card (one that carries an annual fee), your points are worth even more.

Great offer for a no annual fee card! A no-brainer, great business card. Your choice to receive 1.5% cash back or 1.5x points.