0% introductory APR credit cards offer new cardholders 0% interest for a period of time—which makes them appealing to those who are looking to offset the cost of large purchases or balance transfers.

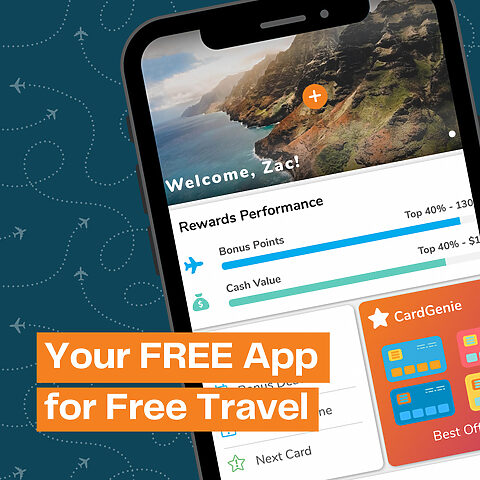

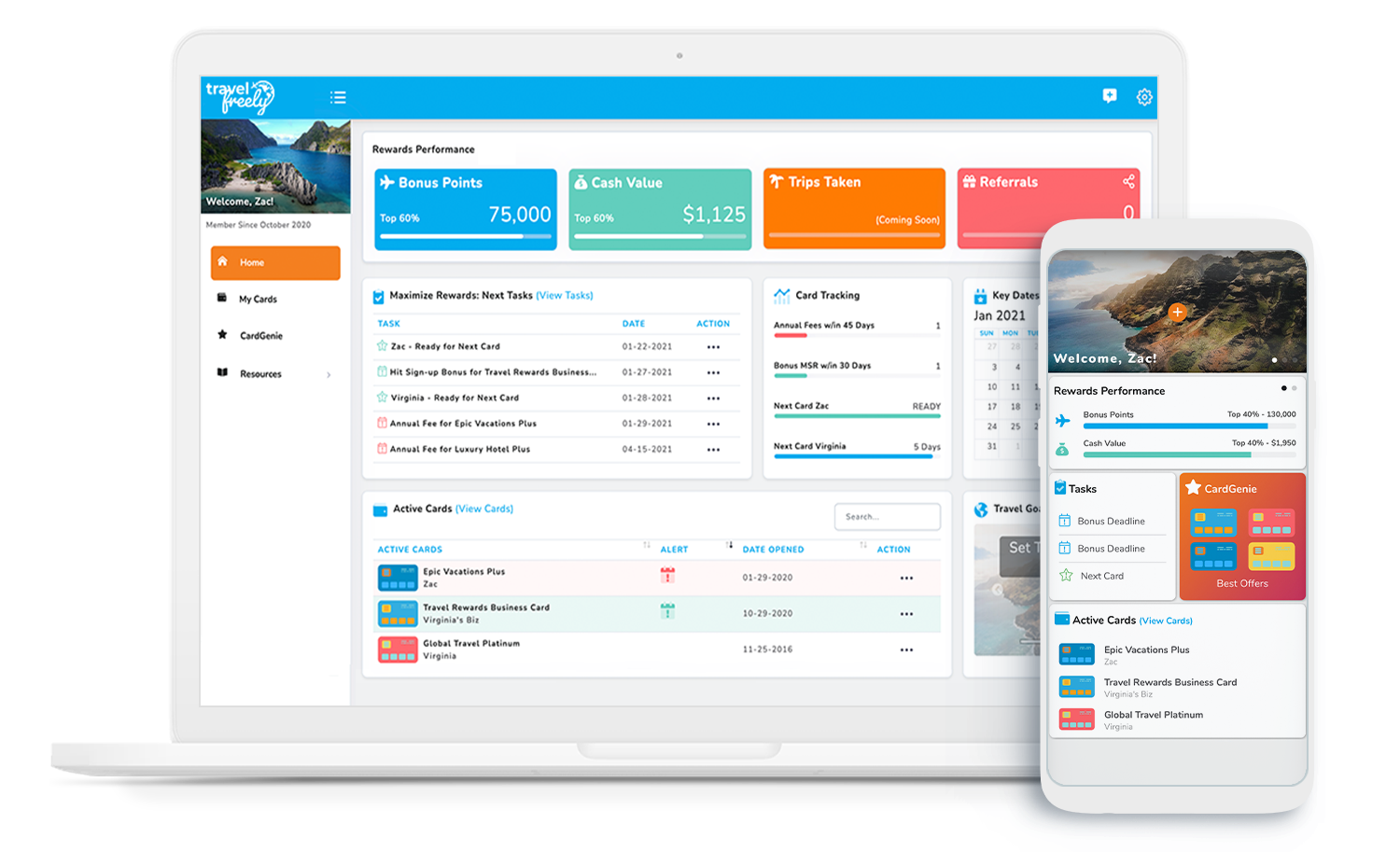

When it’s time to decide which card to open, we’ve simplified things with our “Best Of” rankings for the best credit cards for carrying a balance. If you don’t have time to research cards, take advantage of our expertise!

Our Top Recommendations

Best cards for Carrying a Balance and Balance Transfer: If you’re looking for the best balance transfer options, think about the Citi® Diamond Preferred® Card for a balance transfer and 0% on purchases option. The next best option would be the Citi Double Cash® Card. Also, almost all balance transfer offers still include a fee for the actual transfer. Make sure to read the terms for all cards before signing up.

Note: You will not earn rewards for the actual balance transfers. Make sure to check terms when applying. For cards that are great for carrying a balance, check out the Amex Blue Cash Everyday or Chase Freedom Unlimited® because they also have a welcome bonus.

Now with a signup bonus! A great complement to the Citi Premier card.

In addition to the welcome offer you receive after meeting the minimum spend requirement, you'll also receive 10% back as a statement credit on purchases made at restaurants worldwide within the first 6 months of card membership (up to $150 back). Definitely worth considering if you're looking for a cash-back card, as you'll earn 3% cash back on several credit cards. Cash back is received in the form of reward dollars that can be redeemed as a statement credit. Terms apply.

With the current offer, you'll now earn a total of 4.5x on dining (including takeout and eligible delivery services), 4.5x on drugstores, 6.5x on travel purchased through Chase Travel℠, and 3x on everything else for the first year, up to $20,000. This special offer is best for those who have a healthy amount of monthly spending on dining and general expenses.

Best Business Cards for Carrying a Balance

Great offer for a no annual fee card! A no-brainer, great business card. Your choice to receive 1.5% cash back or 1.5x points.

Great signup bonus for a business card with no annual fee, now with an extended timeline for hitting the spend requirement. Great for carrying a balance. 5x earning categories, and if paired with a premier Chase credit card (one that carries an annual fee), your points are worth even more.