So, you just earned the bonus on your Chase Sapphire Preferred® Card. But, what’s next?

By signing up for your next card, you’ll maximize your rewards and expand your ability to book free travel.

With your new Chase Sapphire Preferred® in your wallet, you’ll want to keep the momentum going by earning more points. We’ve made this simple and easy for you to find the next best card to maximize your overall value and flexibility for free travel.

Don’t let this information overwhelm you—you’ve already taken the first step. No matter which card you decide to open next, you’re on the right track! You’ve signed up for our #1 beginner card and snagged one of the best signup offers. Free travel is now yours, and you’re well on your way to making great memories in new places. As you decide which card to open next, there are a few things we want you to keep in mind.

Disclaimer: If you decide to open up one of these cards, we’d love for you to sign up using one of our links on this page. We work hard to bring our app and content to you for free. By using the links on our site to apply for credit cards, you’ll help support the site in a big way.

If you’re anything like me when I hit my first signup bonus, you’re probably already contemplating which card you’ll open next. You have a few routes you could take, and we’ve separated the information out by the various situations in which you might find yourself.

Don’t have time to read the whole post? We’ll break down your options below, but the best option for most people is the Citi Premier® Card or Capital One Venture X Rewards Credit Card for the flexible rewards system and redemption options.

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."

If You Have a Partner

If you have a significant other who does not have their own Chase Sapphire Preferred, this is definitely the first next step to take. Couples have separate credit profiles, so each person can get a primary card to double up on the bonus. Not only is it super valuable for each of you to earn the sign-up bonus for one of the best beginner cards out there, but you can also combine your points together for even greater redemption!

If you’re hesitant to pay the annual fee for two of the same cards, it’s important to note that you can easily close or downgrade one of these cards after a year. Paired with the many perks Chase provides for account holders, you might find that this card is well worth the annual fee (even for two people)!

Quick tip: There’s no need to worry if your partner is listed as an Authorized User on your card. They can still open up a card for themselves—making this a huge win! You can also refer your partner for their own version of the Chase Sapphire Preferred, which means double the welcome bonuses plus referral points.

Where will you go next with another big signup bonus?

If You Have a Small Business

An easy next step for those who have just opened a Chase Sapphire Card is to move on to one of the three Ink Business Cards offered by Chase. They each boast a hefty sign-up bonus and are extremely valuable when looking to earn transferable points. Each of these cards has its own perks, but we recommend the Ink Business Unlimited because of its generous sign-up bonus and simple earning structure.

The #1 reason to get an Ink business card after your Chase Sapphire Preferred is because you can pool your points into your Sapphire account. With the bonuses of both cards, you’ll have a treasure chest of around 160,000+ points and well over $2,000 in free travel! Keeping all of your Chase Ultimate Rewards points in one “bucket” will help you when it comes time to redeem those points for free travel.

Extra Tip: Plus, getting a business card next will allow for even more space between your personal applications when it comes time to get your next personal card.

Great offer for a no annual fee card! A no-brainer, great business card. Your choice to receive 1.5% cash back or 1.5x points.

Great signup bonus for a business card with no annual fee, now with an extended timeline for hitting the spend requirement. Great for carrying a balance. 5x earning categories, and if paired with a premier Chase credit card (one that carries an annual fee), your points are worth even more.

Contrary to popular belief, you don’t have to have a big business in order to qualify for a business credit card. In fact, sole proprietors can apply for business credit cards without any official business registration. Check out our blog post, “Am I Eligible For a Business Credit Card?” to read more about eligibility and learn how to apply for a Chase Ink card as a sole proprietor. Trust us, most people find they are eligible for business cards with the smallest side hustle!

Advanced Tip: Business cards do not impact your 5/24 status (as with most other business cards). However, you do need to be under 5/24 in order to be approved for these cards. Read more below about the Chase “5/24 rule.”

If You Want to Keep Things Completely Simple

If you don’t have a small business, the Citi Premier card is a top contender for the next card you should get. This card is consistently one of our highest-rated cards for beginners, and for good reason! Most notably, this card is essentially Citi’s version of the Chase Sapphire Preferred card and has a great signup bonus that is best used when transferring to one of Citi’s transfer partners, or when redeemed as cash back for travel expenses. The value of your points in the portal is the same as cash back (at 1 cent per point), so if you prefer to book directly with an airline or hotel, this is definitely a sweet card for you.

This simple rewards card is also a good option for those whose spouse or travel companion isn’t as involved in credit cards or rewards as you are (we’ve all been there)!

Check out this post to learn more about the Citi Premier card and why we love it!

Zac used 72,000 miles to travel on business class to France. Air France is a transfer partner of Citi!

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."

If You Want to Stick with Chase (and don’t want to open many cards)

If you don’t see yourself opening many cards, but want to maximize your Chase Ultimate Rewards points, you might consider the Chase Freedom Unlimited® or Chase Freedom® Flex®. For solo travelers, or those who aren’t interested in opening several cards, using one of these cards for earning on everyday purchases could be an ideal addition to your wallet.

While these cards don’t offer huge sign-up bonuses, these no-annual fee options have very straightforward earning structures and allow you to easily move all of your points to your Sapphire card for a greater redemption value.

With the current offer, you'll now earn a total of 4.5x on dining (including takeout and eligible delivery services), 4.5x on drugstores, 6.5x on travel purchased through Chase Travel℠, and 3x on everything else for the first year, up to $20,000. This special offer is best for those who have a healthy amount of monthly spending on dining and general expenses.

If You Want a Premium Rewards Credit Card

A premium rewards card is a travel rewards credit card that often includes travel perks and benefits in addition to the sign-up bonus. And, these cards usually come with a higher (but, usually worth it) annual fee.

Our favorite premium rewards card is the Capital One Venture X Rewards Credit Card—an ultra-premium credit card from one of our favorite banks.

While this card has a $395 annual fee, it also comes with a wide range of benefits that, in our opinion, far outweigh the annual fee. Like, a $300 annual travel credit to be used for travel bookings via the Capital One Travel Portal, a 10,000-mile bonus each account anniversary, receive up to a $100 credit for Global Entry or TSA PreCheck® (valid every 4 years), and access to Capital One Lounges and over 1,300 Priority Pass Lounges worldwide.

You can choose to redeem your Capital One Miles to book travel through their Capital One Travel portal or transfer to a variety of transfer partners at a 1:1 ratio.

With 2x on every purchase and a redemption value of 1 cent per mile (25,000 miles = $250), you’ll find great value in the sign-up bonus and various redemption options.

For more information on this card, check out our blog post, “Is the New Capital One Capital One Venture X Rewards Credit Card Worth It?“

Great "ultra-premium" card. Despite the big annual fee, the overall first year value is worth it for most people. This is due to the large signup bonus, extra benefits like Priority Pass, up to $300 annual travel credit and Global Entry/TSA PreCheck credit.

Not up for a big annual fee, but love the idea of easy earning and redeeming with Capital One Miles? Another Capital One card for consideration is the Capital One Venture Rewards Credit Card. This is the original Venture card that has been a staple for so many beginners.

Best "easy to use" starter card (or complement to the Chase Sapphire Preferred) for those who don't want to think when it comes to earning and redeeming miles.

Things to Keep in Mind

Strategy is Key

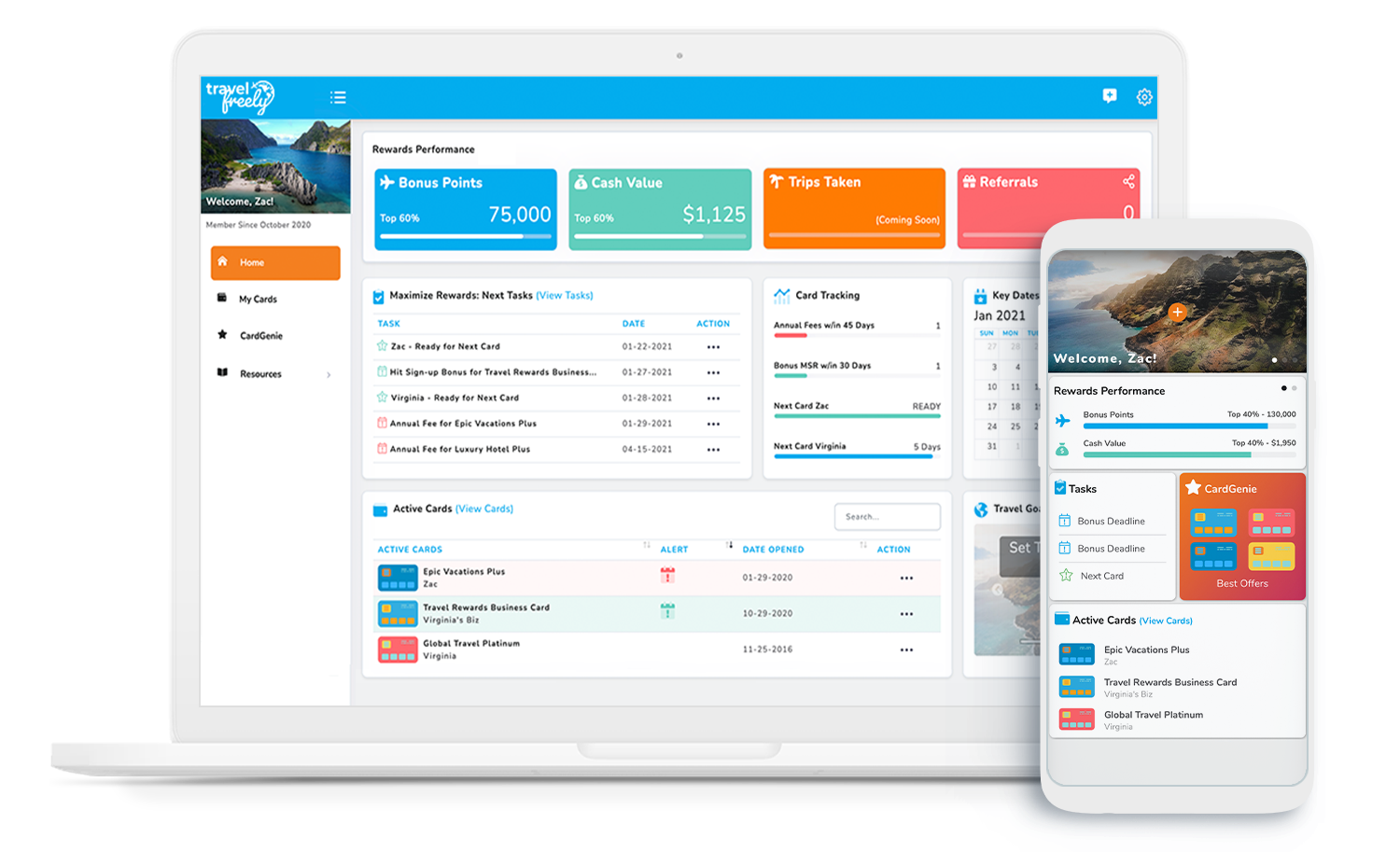

If you’re ready to open a new card, it’s important to have a strategy in mind. After all, you want your next card to count as much as the Chase Sapphire Preferred. It’s best to wait 90 days between opening cards, but there are a few exceptions to this rule (especially if you own a business). Travel Freely members can use their app to track when it has been 90 days since they last opened a card.

The 5/24 Rule

If you’re new to rewards credit cards, you may not be familiar with Chase’s 5/24 rule. Simply put, Chase will deny your application if you’ve opened 5 or more personal cards in the last 24 months. So, if you’re in this for the long haul, you’ll want to prioritize Chase cards over other card issuers. As a reminder, business cards do not count towards your 5/24 status (with the exception of CapitalOne, TD Bank, and Discover). You can check your 5/24 status, here!

The Travel Freely App Can Help You Stay Organized

A common concern with opening many cards is that keeping track of annual fees, 5/24 status, spending categories, and on-time payments can seem daunting. With the Travel Freely app, you receive automated reminders for bonus deadlines, annual fees and track your 5/24 status. Even more, you can keep track of the cards for both you and another person!

What Loyalty Programs and Transfer Partners Are You Interested In?

Have you done window shopping and have a trip in mind for your next points? Creating hotel and airline loyalty accounts to browse how many points and miles you will need for a specific trip is essential to planning your card strategy. If you know you’ll need flexible points to transfer to the airline or hotel brand you want to book with, make sure the points you earn with your next sign-up bonus will serve that goal. Check out Rewards HQ: Loyalty Programs and Transfer Partners to learn what points transfer to specific programs and brands.

Don’t see a card in this post that you like? The CardGenie feature in the Travel Freely app will make card recommendations for you based on your 5/24 status and the cards you currently have open.

Summary

You have many choices when it comes to your next step, and earning your bonus on a Chase Sapphire card is just the beginning. It’s exciting to see your points accumulate and help pay for a trip for which you’d otherwise have to break the bank. Sign up for your next card, and be well on your way to earning more free travel.

Cards listed in this post:

Chase Ink Business Unlimited; Chase Ink Business Preferred; Chase Ink Business Cash